Did you hear that collective exhale across the country last week? With the election officially behind us and attention firmly on the final few weeks of the year, if feels like we’re back to our regularly scheduled economic activity ahead of the holidays. And with that, retailers and consumers are keenly focused on making the most of the holiday shopping period.

We already know that the National Retail Federation is projecting modest growth during the holiday shopping period, which is already under way and runs through the end of the year. But there’s plenty of nuance to this time of year and its impact on businesses of many shapes and sizes.

Here’s a look at a few data points and trends that we’ve spotted, which will be helpful to know ahead of the most-watched and scrutinized weekend of shopping on the retail calendar.

1. 38 Percent of Consumers Will Shop In-Store on Black Friday

This number only tells a portion of the story around in-store shopping on Black Friday. Take into account that another 42 percent of consumers surveyed in KPMG’s 2024 Consumer Pulse Holiday Report said that they “may go” shop in store, and you’re talking about 80 percent of consumers who plan to shop on Black Friday doing so in-store. On the other end, just 2 percent of consumers surveyed said they either “definitely won’t” or “probably won’t” go in store to hunt for deals.

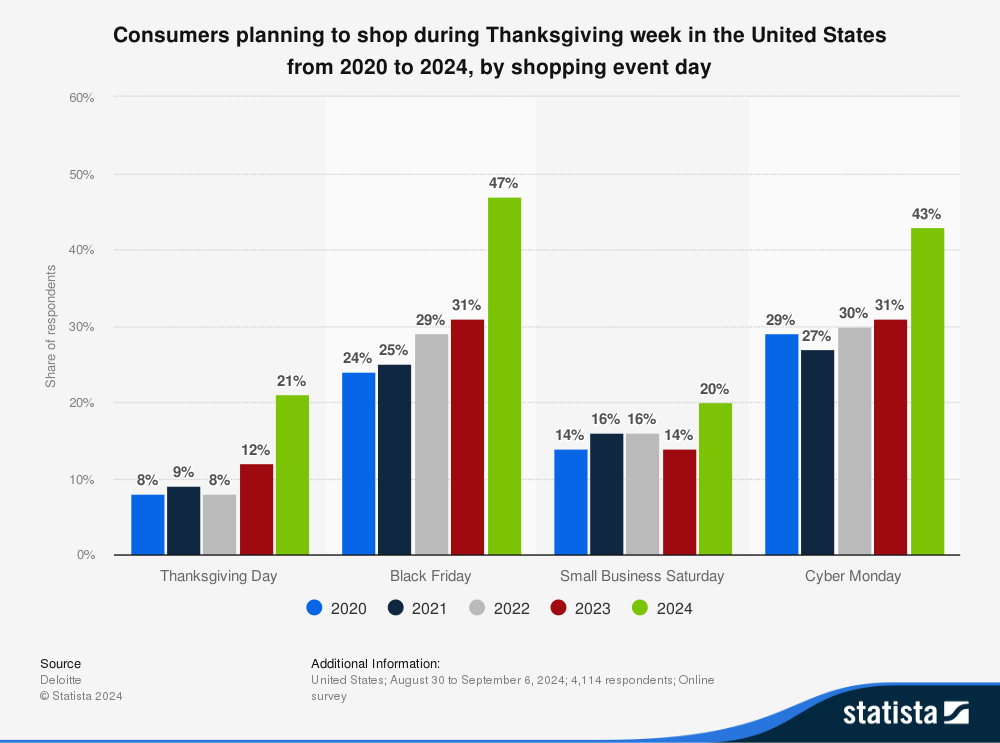

Another holiday report shows that participation throughout the holiday shopping weekend will be up this year. According to Deloitte’s 2024 Holiday Retail Survey, around 47 percent of all consumers plan to shop on Black Friday, a 16 percent jump from last year. Another 43 percent said they will shop on Cyber Monday – up 12 percent from last year. Small Business Saturday also saw a strong increase compared to previous years, rising to 20 percent for 2024, up 6 percent compared to last year.

No matter which report you’re pulling from, it’s fantastic news for retailers hoping to see an increase in foot traffic during the Black Friday weekend.

2. E-commerce to Drive Majority of Cyber Week and Holiday Spending

Despite the intent of consumers to get off their couches and get into stores during the Black Friday weekend, it’s still expected that online and mobile spending will dominate the weekend.

Even if you remove Cyber Monday from the equation, online shopping appears to be the preferred method for consumers – except for the period after Christmas until New Years. In-store shopping also holds a slight lead during the Saturday and Sunday after Thanksgiving, but not by much, according to PwC’s 2024 Holiday Outlook report.

As for actual projected e-commerce spending during the Black Friday weekend, Cyber Monday will, of course, see the most dollars spent this year online (roughly $13.2 billion, according to Adobe Analytics), followed by Black Friday ($10.8 billion) and Thanksgiving day ($6.1 billion).

3. Spending per Person May Decrease Slightly

While NRF projects that overall spend during the holidays will tick up, economic factors, rising costs of living and other headwinds are expected to result in a moderate decrease in per person spending during the holidays. According to Drive Research, most consumers (22 percent) plan to spend between $400- $599 this year on their holiday shopping. Another 20 percent of shoppers plan to spend over $1,000 – down from 23 percent last year. About 32 percent of shoppers plan to spend $399 or less during the holiday season.

4. 75 Percent of In-Store Shoppers Plan to Purchase Electronics

Clothing (81 percent) and electronics have long been the dominant categories during the Black Friday weekend, so it’s no shocker that those two areas top the list. But those aren’t the only products on consumers’ wish lists this year. Among the other must-haves, according to Drive Research:

- Home appliances – 49 percent

- Interior home design products – 34 percent

- Furniture – 33 percent

- Outdoor product – 19 percent

Needless to say, the Independent retail segment is well represented up and down consumers’ holiday shopping lists – a major opportunity to attract them into your stores and onto your websites.

5. Electronics, Furniture and Appliances Drive Most BNPL Usage

With tighter budgets and less discretionary spending expected, consumers could turn to more alternative payment methods to help lessen the burden of their holiday purchase this year. And, according to KPMG’s holiday report, our Independent retailers’ core categories drive the highest usage of Buy Now Pay Later spending. According to their report, BNPL is preferred by 40 percent of consumers shopping for electronics and appliances and 29 percent of consumers shopping for furniture.