UPDATED MARCH 6, 2025: The 25 percent tariffs on Canada and Mexico are paused until April 2, 2025 for many imported goods, as reported by AP News. In a message from the Oval Office, President Trump noted that there are no plans to further extend the exemption beyond the new April 2 deadline.

Per AP News coverage:

“Imports from Mexico that comply with the 2020 USMCA trade pact would be excluded from the 25% tariffs for a month, according to the orders signed by Trump. Auto-related imports from Canada that comply with the trade deal would also avoid the 25% tariffs for a month, while the potash that U.S. farmers import from Canada would be tariffed at 10%, the same rate at which Trump wants to tariff Canadian energy products.”

We will continue to provide tariff updates as new information becomes available.

ORIGINAL ARTICLE posted March 4, 2025:

It’s official.

As the clock struck midnight on March 4, 2025, tariffs on Canada and Mexico went into effect — along with an additional 10 percent tariff on China which puts Chinese tariffs at 20 percent total, following an initial 10 percent tariff hike last month.

This news comes after a 30 day pause on negotiations between the U.S. and its neighbors to the north and south. As reported by CNN, the White House released a statement on March 3, stating that, “While President Trump gave both Canada and Mexico ample opportunity to curb the dangerous cartel activity and influx of lethal drugs flowing into our country, they have failed to adequately address the situation.”

Both Canada and China retaliated immediately, and Mexico will announce retaliation details on Sunday. According to AP News, China increased tariffs on U.S. farm exports by up to 15 percent and is now subjecting an additional two dozen U.S. companies to export controls and other restrictions. And Canada plans to enforce new tariffs on more than $100 billion in U.S. goods over the next 21 days.

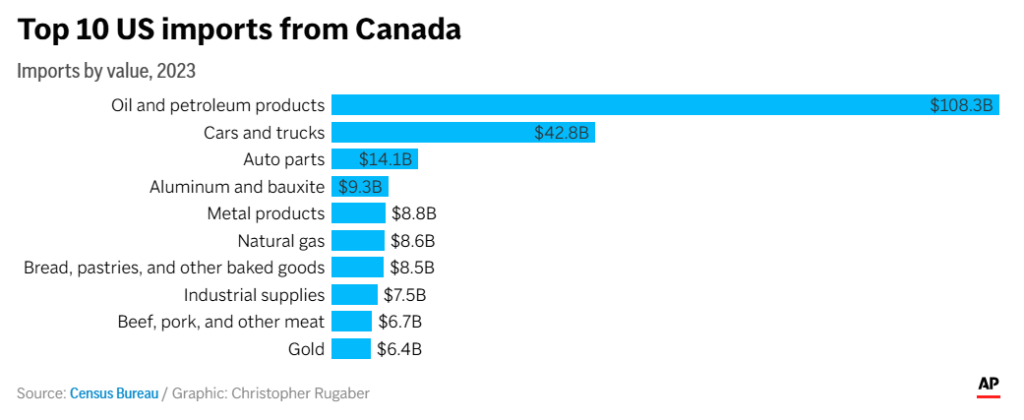

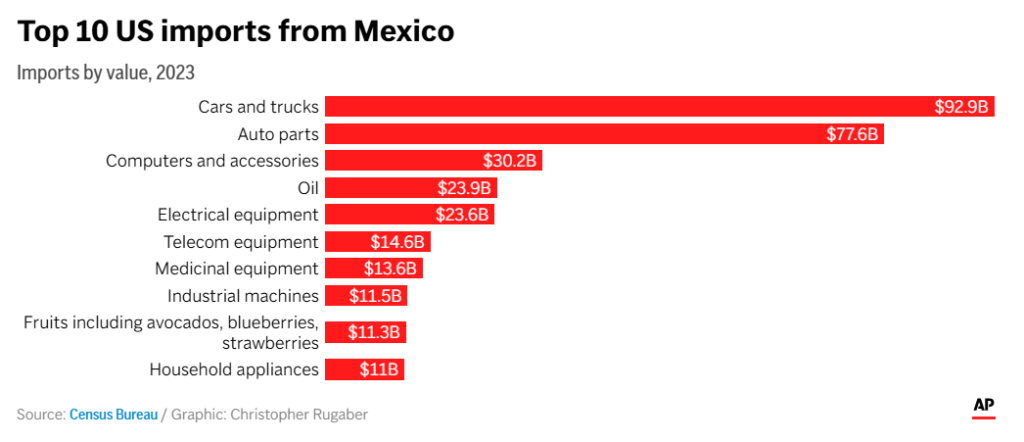

In 2024, imports from Canada, Mexico and China together accounted for 40 percent of the value of all American imports, equating to $1.4 trillion. Here’s a look at the top 10 import categories from Canada and Mexico alone.

Source: Census Bureau

Source: Census Bureau

Impact of Tariffs on Consumer Spending

Retail industry news site Retail Brew recently reported that Americans have been “doom spending” on larger purchases, with 22 percent stockpiling essentials to mitigate the effect of potential price hikes, per a recent study by CreditCards.com.

“Since Trump’s election, 28% of consumers have made a purchase exceeding $500, while 21% haven’t yet made a large purchase but plan to in the near future. Of those that have bought pricey items, 22% said the tariffs were a main factor, and 30% said they had some impact on their decision. The top items purchased were electronics (39%), home appliances (31%), and home improvement materials (25%).”

Speaking of home improvement materials, Canada is the #1 supplier of lumber to the U.S., which means those 25 percent tariffs could cause issues like shortages in building materials, delays in construction and new developments, and a greater increase in home prices.

“Tariffs on lumber and other building materials increase the cost of construction and discourage new development, and consumers end up paying for the tariffs in the form of higher home prices,” the National Association of Homebuilders, a lobbying group, said in a statement in January that was published on news site Axios.

What’s Next for Tariffs?

President Trump already announced that reciprocal tariffs will go into effect on April 2. This means that any country who imposes a retaliatory tariff on America will be hit with new or additional tariffs, including Canada, Mexico and China.

But the big three aren’t the only countries impacted. The European Union will also soon be faced with a 25 percent tariff on cars and other exports.

Stay tuned as we keep an eye on the latest to keep you informed.