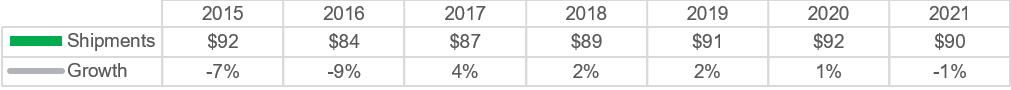

Economic indicators aside (unemployment, housing market, wage growth, etc.), total television revenue grew an incredible 6% in the domestic market from the previous year (2017 vs. 2018). This is due largely to the recovery in personal disposable income, which – coupled with new technologies – has aided in the shortening of the television upgrade cycle.

While we’re far from being out of the woods and recognizing that one year does not make a trend, it is safe to say that retailers are now experiencing growth in and optimism about what has been a challenging business for many years. Here’s a quick look at where we’ve been and what we expect to see over the next 18 months.

TV Forecast by Technology – Units

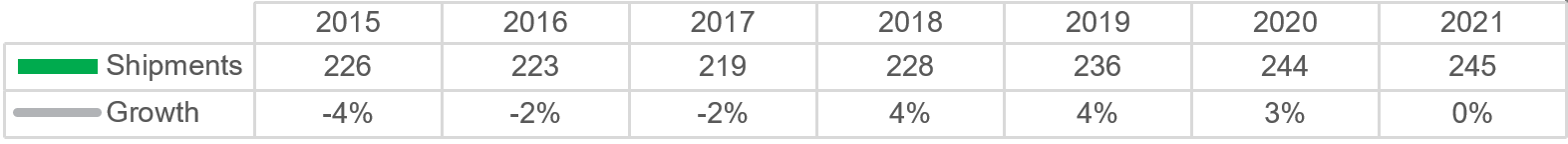

Total shipment forecasts range from flat to single-digit growth projections. It’s within the premium space and larger-screen segments of the business where opportunity (and growth) will present itself.

Total TV Shipments and Growth (Millions)

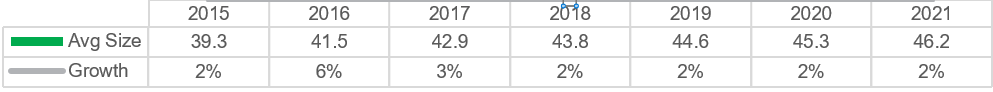

TV Average Screen Size

Source: IHS

TV Forecast by Technology – Revenue

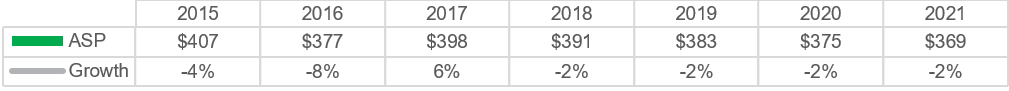

Much like unit shipments, television revenue is also forecasted with conservative growth projections. This is due to an expected 2% decrease in average sales prices for the next three to four years, as well as continued commoditization of ultra-high-definition (UHD) models.

Total TV Revenue and Growth (Billions)

TV Average Sales Price

Source: IHS

Three key trends have helped television revenues stabilize and are expected to encourage slight growth into 2020.

- Average screen size growth has helped offset price erosion, and screen size is expected to continue growing by 2% compound annual growth rate (CAGR) over the next five years.

- Panel prices have generally stabilized, with only slight increases in sub-55” screen sizes.

- The growth in the premium market (i.e., organic light-emitting display [OLED]) will increasingly support revenue stabilization for the next 18 months.

Areas of Opportunity

While the television market remains a challenging category, a few segments offer profitability and growth potential for retailers.

- 4K/8K TVs – Although commoditization has begun in UHD, production costs are expected to fall faster than retail prices, yielding an opportunity to profit. This, coupled with improved price policies for both manufacturer’s advertised price (MAP) and unilateral price policy (UPP), will help to protect a disruptive market and stabilize retail. Following 4K TV, we now have 8K entering the market, albeit with limited supply at premium retails. Like 4K, 8K will be limited in volume contribution in 2019. But given the promise of twice the resolution of 4K, this technology has the potential to breathe new life into the television business – as much as content will enable it to.

- Larger Screen Sizes – 55” and larger televisions show the most upside in terms of volume growth over the next few years. The average screen size will grow approximately 2” each year, and the U.S. market heavily favors big-screen TVs. By 2021, the average screen size is expected to land between 46-48” vs. the 39” of just a few short years ago.

- Premium TVs – After years of price erosion and value television offerings, a trend is emerging around performance. HDR (High Dynamic Range) and WCG (Wide Color Gamut) – via better LED chips, thicker color filters and quantum dots – are on the rise and offer a technology storyline for multiple brands. There remains to be a true go-to-market strategy to support the full benefits here, but these innovations do offer significantly improved picture quality.

While the television business can be challenging to understand at times, I believe retailers have a bright future ahead. Not only is the heart of the home entertainment room centered around the television, creating endless possibilities for today’s consumers, but emerging technologies and more stable price points are opening up a world of sales opportunities. In short, there is much to be excited about.