As the industry continues to barrel ahead in the face of numerous challenges, Independent retailers reported another month of strong confidence levels and sales performance.

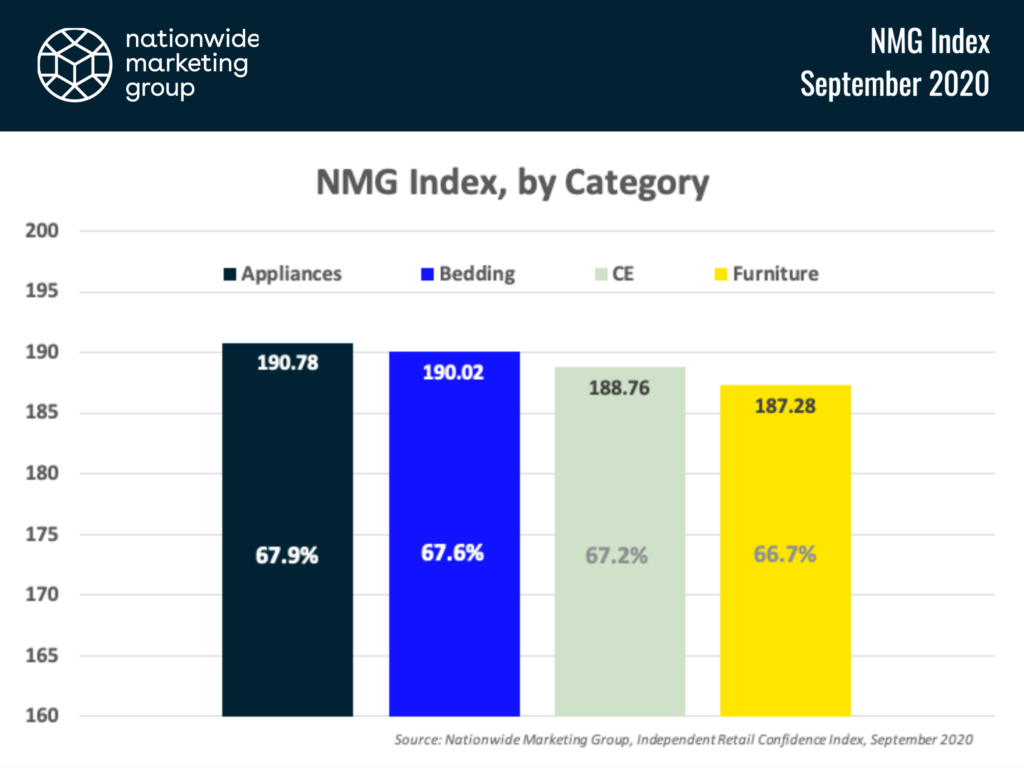

The second edition of the Nationwide Marketing Group Independent Retail Confidence Index (NMG Index) saw the overall confidence level slide just under 2 points in September to 190.57 (from 192.521 in August). Percentage wise, the NMG Index moved down less than 1 percent to 67.8% (from 68.5% in August), still strongly tilting towards the more confident end of the scale.

According to retailers’ open responses throughout the survey, the slight dip can be attributed to uncertainty around product availability moving forward.

“Demand has been good … and we have exceeded every month since the start of the pandemic. Much will depend on product availability in specific areas,” said one retailer. Another reported “the highest volume of delays in the history of [their] company.”

Despite challenges in the supply chain, retailers are for the most part continuing to see a steady flow of business as most of the country “gets back to normal” and stores reopen. At the height of the coronavirus lockdown, over 1,200 Nationwide Members closed their stores either voluntarily or because of local shutdown mandates. To date, nearly all of those stores have reopened.

Store Traffic

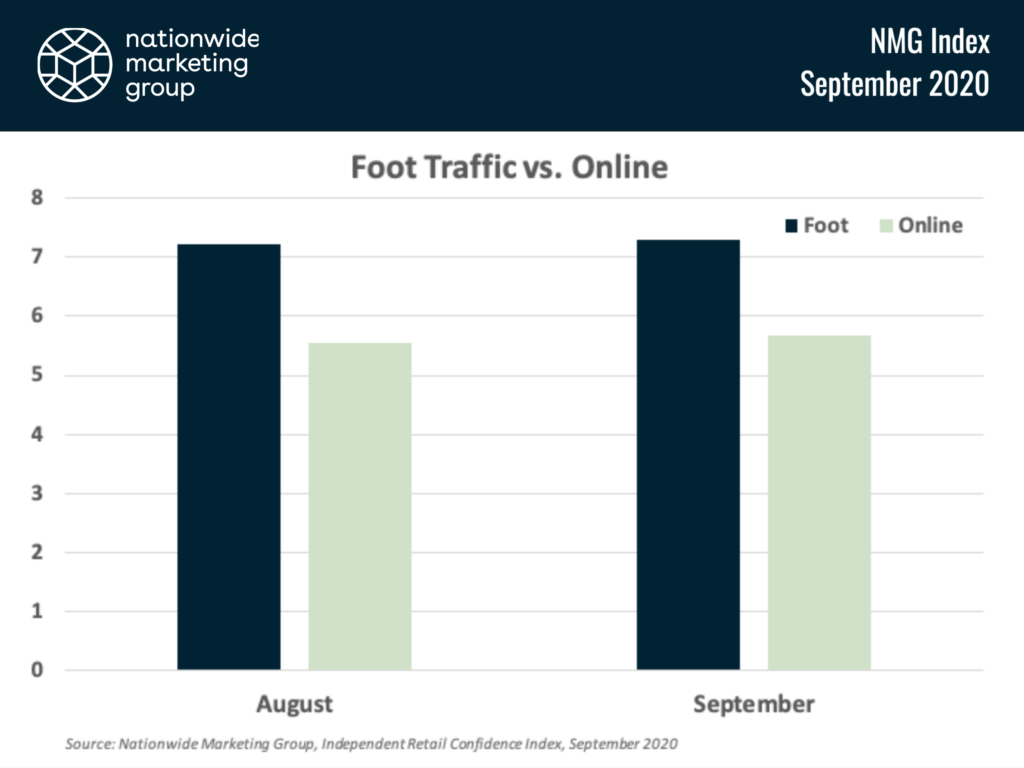

Some retailers stressed concern over the potential for a second shutdown as coronavirus cases in their regions trend in the wrong direction. That said, retailers continue to report high confidence in their ability to drive foot traffic. In fact, in the first two months of the NMG Index, confidence in retailers’ ability to drive traffic into their stores has outpaced their confidence in their ability to drive e-commerce sales.

Retailers seeing stronger foot traffic in the past month point to a combination of increased awareness advertising and consumers in their areas wanting to get out of the house. On the other end of that spectrum, retailers who reported lower confidence in their ability to drive foot traffic almost prefer to have it that way right now for several reasons, among them social distancing and the fact that they don’t have inventory to show off right now.

“I am not sure how much I want to try getting people into the store and not have product to show them,” said one retailer.

Sales Goal Performance

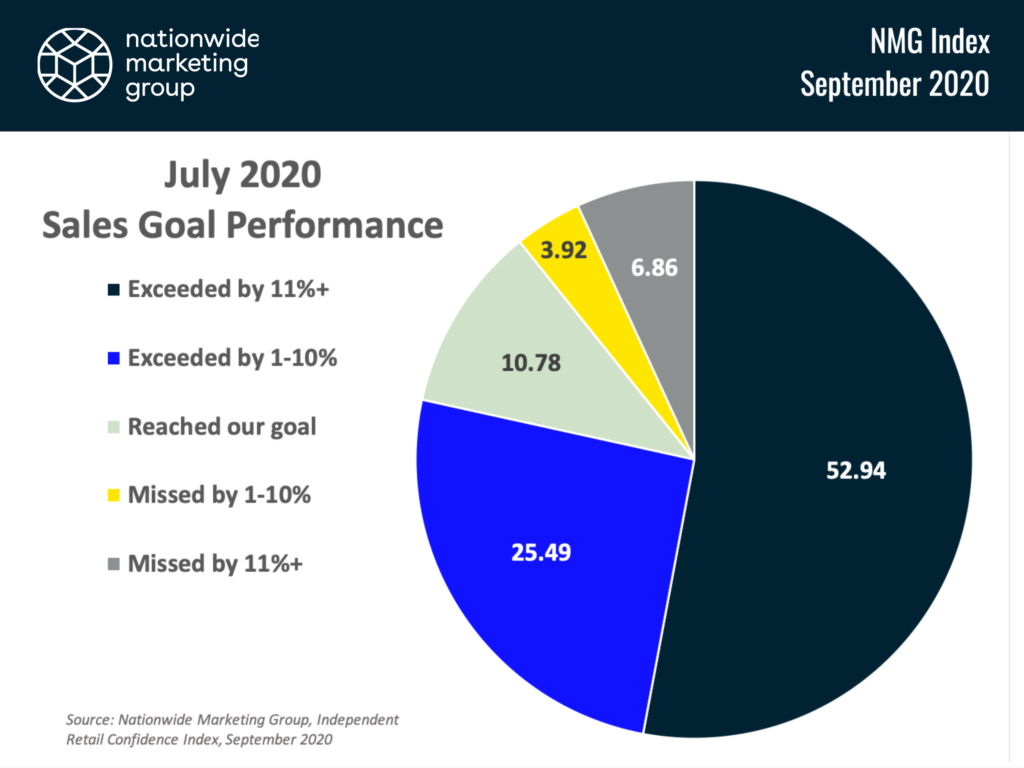

And beyond their strong foot traffic confidence, Independent retailers have maintained an exceptionally high success rate converting that foot traffic into actual sales.

For the second month in a row, the NMG Index survey found that roughly nine out of 10 retailers either met or exceeded their sales goal in the previous month. And, in back-to-back months, more than 75% exceeded their sales goal, with nearly 53% of all retailers exceeding that goal by more than 11%. In July, 78% of all retailers exceeded their sales goal while just under 11% missed their goal.

Product Confidence

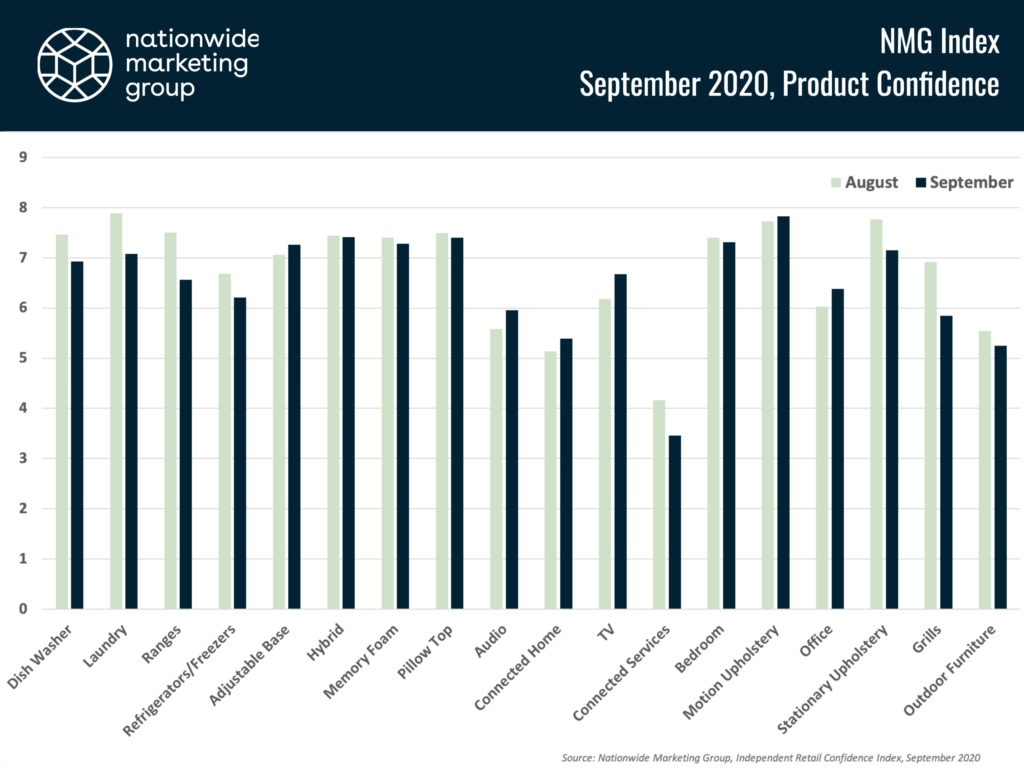

There wasn’t a ton of movement in the product categories month-over-month for the NMG Index. Looked at on a scale of 1-to-10 (where 10 is the “most confident”), the 18 product categories garnered an average score of 6.74 in August. Fast forward a month, and the average score checked in down slightly at 6.52.

The Mattress category showed the most consistency month-over-month barely budging across the four different product types, while Furniture and Appliances saw a mix of ups and downs.

If you are interested in participating in the monthly NMG Index survey, you can sign up right here to have the survey delivered directly to your email.