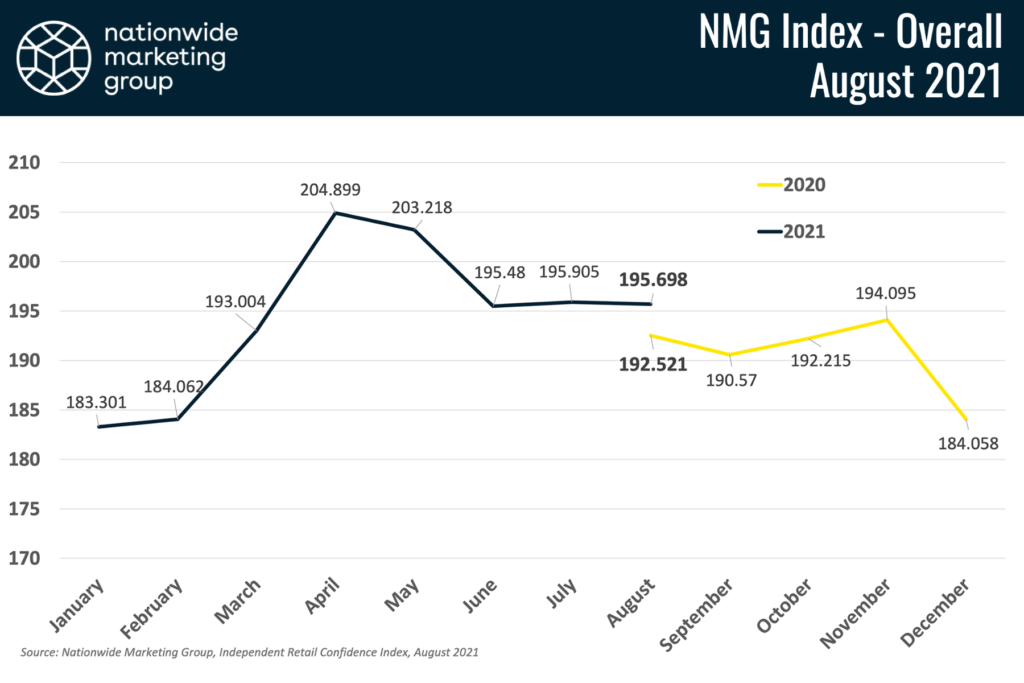

Despite some serious headwinds during the first two months of 2021 Q3, independent retailers have remained essentially unflappable when it comes to their confidence, according to the results of the latest Nationwide Marketing Group Independent Retail Confidence Index. Continued supply chain challenges and a resurgence of the COVID-19 pandemic in the form of the Delta variant, retailers reported their third straight score within the 195-point range. Independent retailers reported an NMG Index score of 195.698 for August (69.64%), “down” roughly one-tenth of a point from July.

This being the 13th NMG Index report, we also get the opportunity to look at our first year-over-year performance metric. To that end, independent retailers saw their confidence jump a little more than 3 points from this same time last year.

“Every month this year has exceeded sales expectations,” reports one retailer. “With one exception, they have all been record months for us.”

That sentiment was shared by many retailers responding to this month’s survey — at least to the extent that traffic and sales have continued to be strong even while product shortages persist. Among the top explanations among retailers for their strong confidence are the still-strong housing market, steady traffic and, in some pockets of the country, the influx of the child tax credit money.

COVID Concerns?

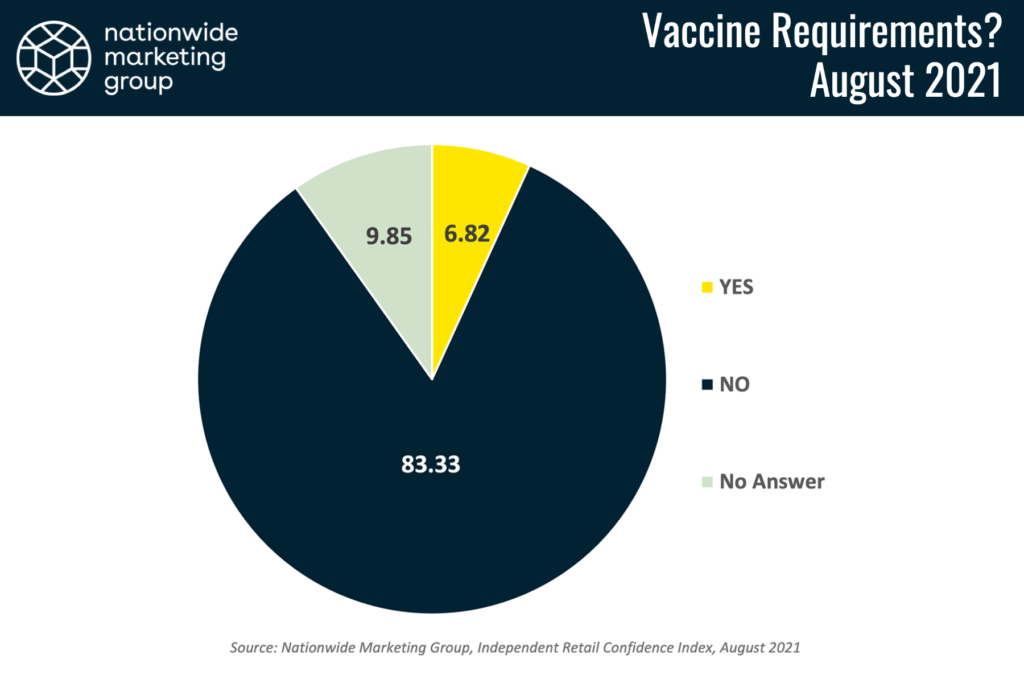

As has been the case for the past 18 months, the ongoing — and resurging — pandemic has many retailers on edge. Some report that traffic has slowed in their communities because of the Delta variant, while others say they fear a potential return to local lockdowns. With the virus still very much top-of-mind, Nationwide, through a new NMG Index partnership with CE retail trade publication Dealerscope, asked dealers if requiring employees to get vaccinated against COVID-19 was something they were considering doing.

Overwhelmingly, retailers said “No.”

Retailers strongly stated that they believe vaccination is a personal choice and not something that should be up to them to decide. That said, many said they encourage their employees to get vaccinated. A vast majority of respondents report that they, themselves, are vaccinated and that most if not all their regular staff members are as well.

Aside from personal choice, labor challenges also seem to impact that decision. A number of retailers said that they feared the possibility of losing critical staff members if they were to require vaccination.

Strong Summer for Products

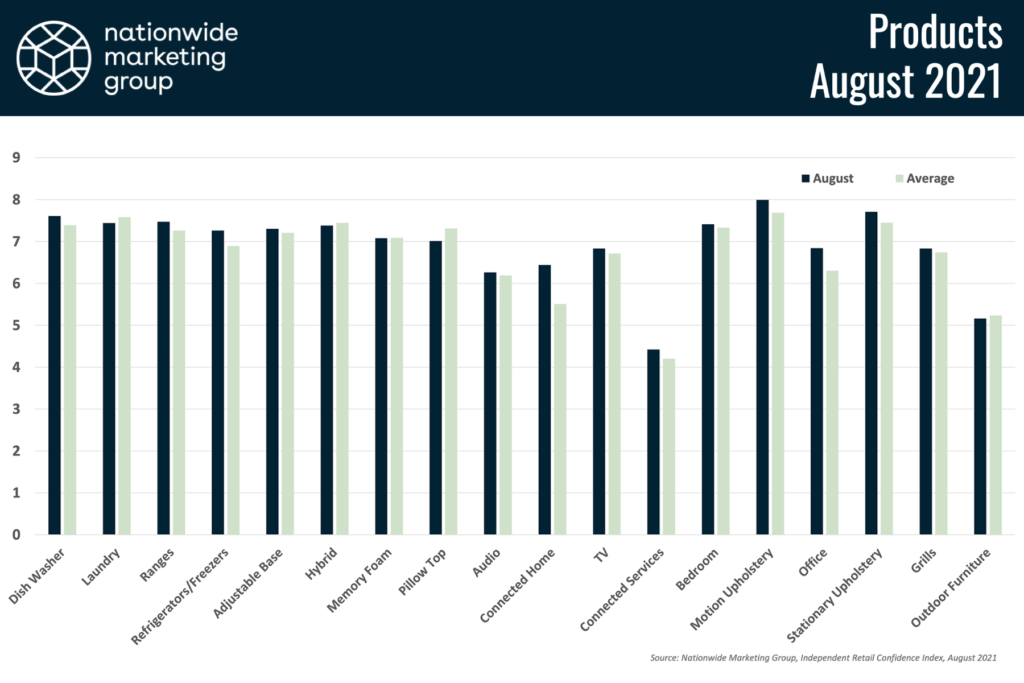

August saw another impressive month for the individual product categories survered for in the NMG Index. This month, 14 of the 18 product categories outpaced their lifetime average scores. And, for the fifth straight month, the average product score for the month across all categories (6.91 for August) was higher than the lifetime average (6.75).

Appliances, typically the strongest-performing category, cooled off slightly in August compared to last month. That was offset by strong gains across the consumer electronics segment. Specifically, the Connected Home category scored nearly a full point higher than its lifetime average, and it was up nearly a-point-and-a-half from July. Furniture also had a strong against-the-average performance for August with three of the four segments reporting gains of at least 0.3 points.

Sales Still Solid

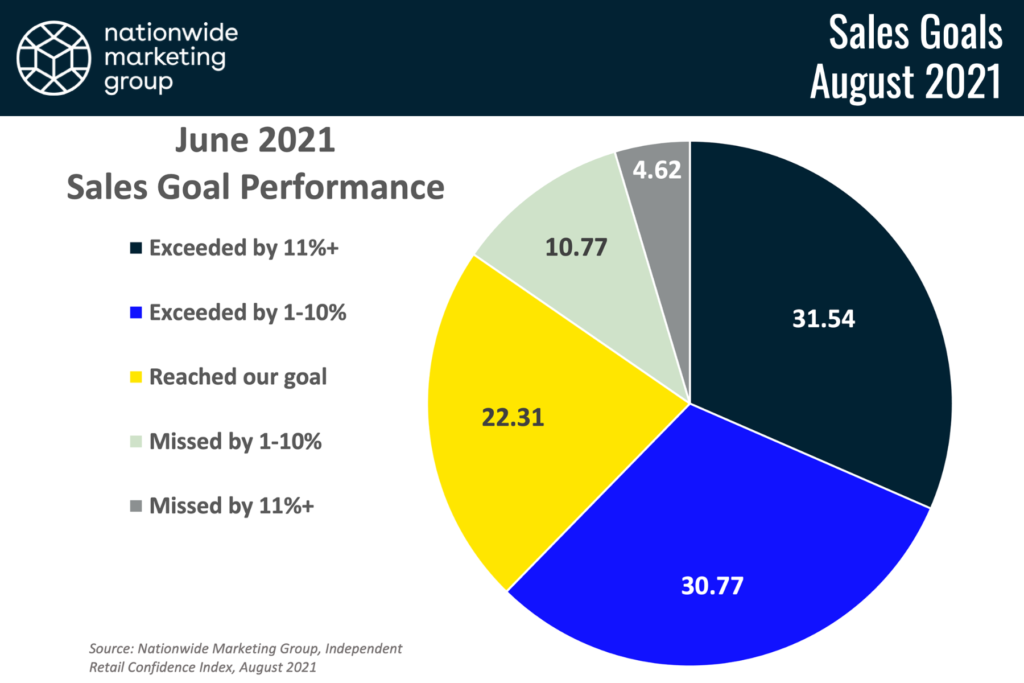

June brought about another strong month of sales goal performance for the independent retail channel. For the month over 62% exceeded their sales goal expectations with another 22% achieving the sales goal they set for themselves.

More retailers did simply this their goal this month than we typically see reported — 22.31% is the highest “reached our goal” figure in the survey’s history. That falls in line with the nearly 8-point drop the NMG Index experienced between May and June. According to retailers at that time, they noticed consumers starting to shift their spending away from the home and back towards more experiential offerings as the economy kicked back into a higher gear earlier this summer. It’s our expectation that, given the way the NMG Index has maintained a sort of status quo over the past three months, we’ll see similar sales goal performance data over the next few months.