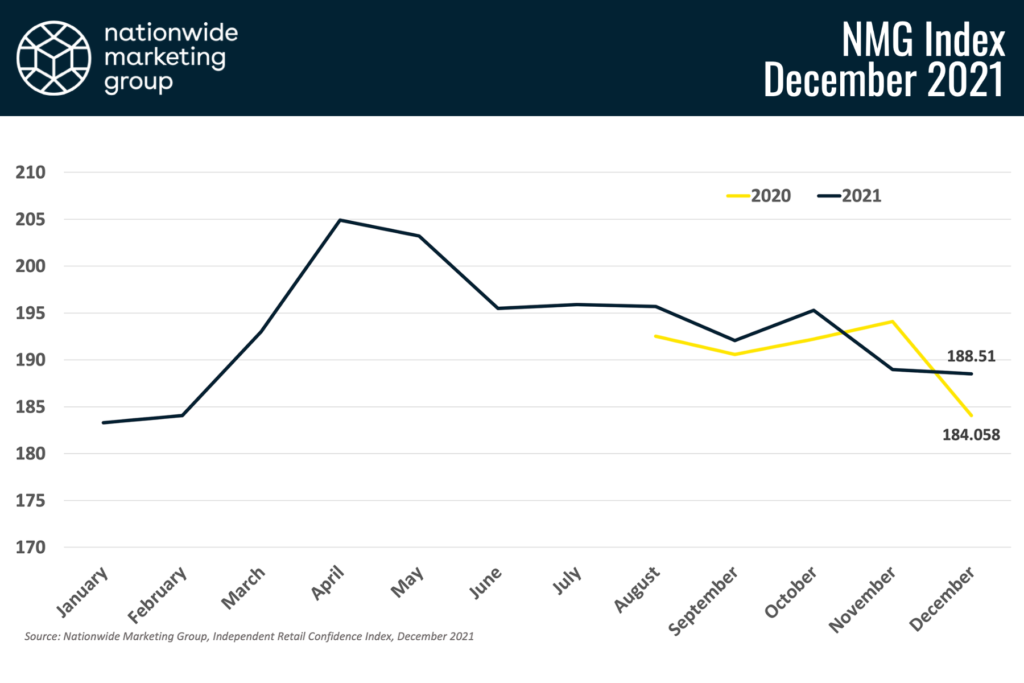

Forget about retail for just a second and think about life in general during the winter months. The second those clocks get turned back, it’s common for one’s personal state of mind to turn somewhat gloomy. It’s darker earlier. Cold weather is setting in — across a majority of the country at least. And we’re all collectively have a little less pep in our step. That’s certainly what Nationwide Marketing Group’s Independent Retail Confidence Index showed last month when confidence declined to its lowest point since last winter.

As we enter these final 31 days of 2021, independent retailers saw their confidence remain essentially flat, month over month. In our latest survey, retailers reported an overall confidence score of 188.51 (67.1%), less than half a point below November’s total. A positive note, this month, is that retailers’ confidence level is roughly 4.5 points above where it was at the same time last year.

It’s a drum that’s been beaten essentially all year — and is likely to continue into the New Year — but supply chain and inventory constraints continue to be among the most mentioned reasons why confidence isn’t higher.

Interestingly, though, a number of retailers reported this month a sense of uncertainty that demand would continue at the rate they’ve seen. So, it’s not that they aren’t seeing customers come into their stores or shop their websites. Rather, they don’t see demand continuing to stay at elevated levels moving forward.

Elsewhere, some retailers are under the impression that the cold winter months, which are predicted to see some rough weather this year in certain pockets of the country, could have a big impact on spending.

“Product availability is OK, not great,” one retailer wrote. “But money is crunching down because of ridiculous fuel, food, and heating costs. A lot of people are going to have a rough winter.”

Traffic Trends

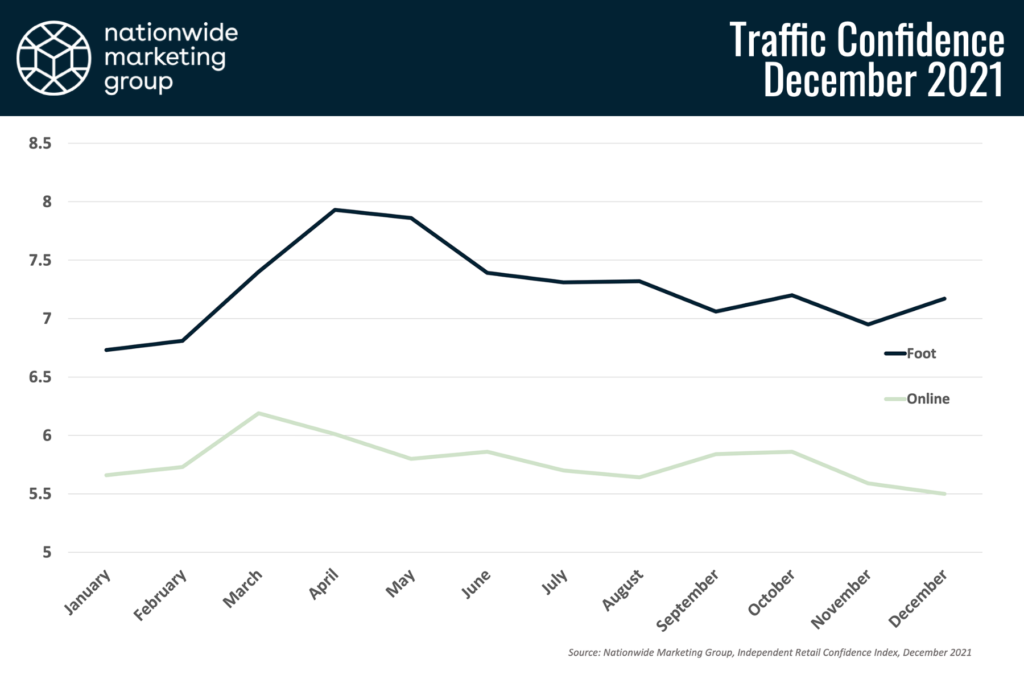

To that end, traffic confidence levels took some interesting turns for December. Regardless of the winter weather outlook, consumers are out and about shopping right now as we’re in the thick of the holiday season.

Overall, foot traffic confidence and online conversion confidence went in different directions in December. Foot traffic was on the rise heading into the month, climbing roughly a quarter of a point; foot traffic, on the other hand, was down slightly and hit its lowest level this year.

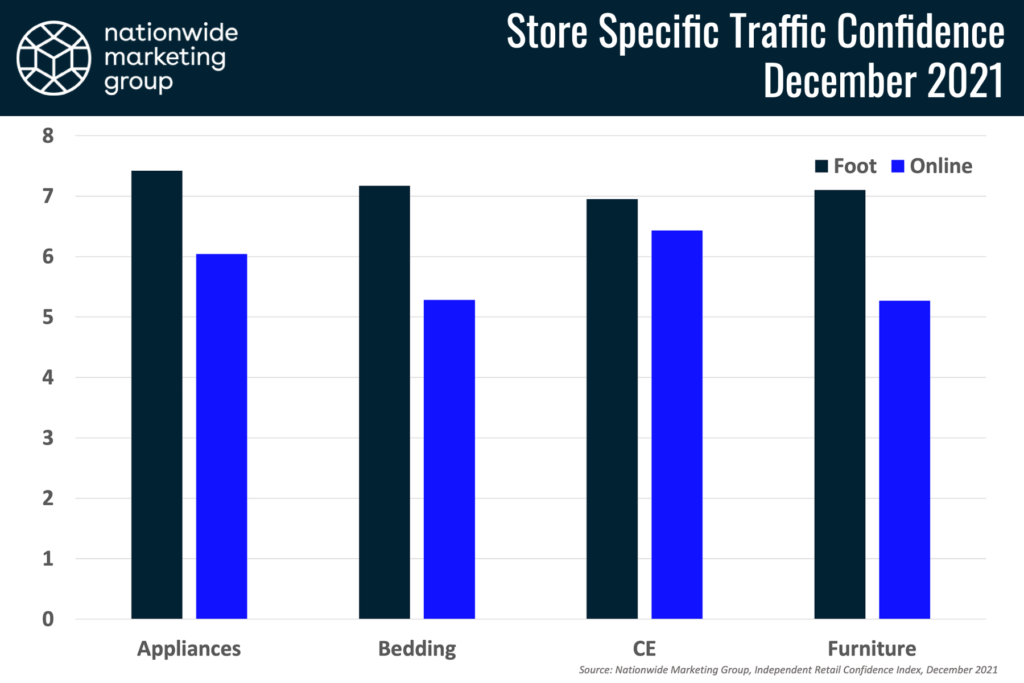

To get a better understanding of the importance of foot and online traffic trends this month, we broke out those confidence levels by store type. Consumers, for a number of years now, have been shifting their holiday shopping online — particularly during the height of this pandemic. But it’s also safe to presume that certain product categories are more likely to see increased digital traffic during this time of year as opposed to others.

As you might expect, Consumer Electronics retailers were the most confident bunch when it came to their online traffic and conversions, scoring roughly 6.5 out of 10 — a full point above the overall online traffic score. Bedding and Furniture dealers, on the other hand, had online traffic confidence levels that fell below the overall score while foot traffic confidence went the other direction.

Products Dip in December

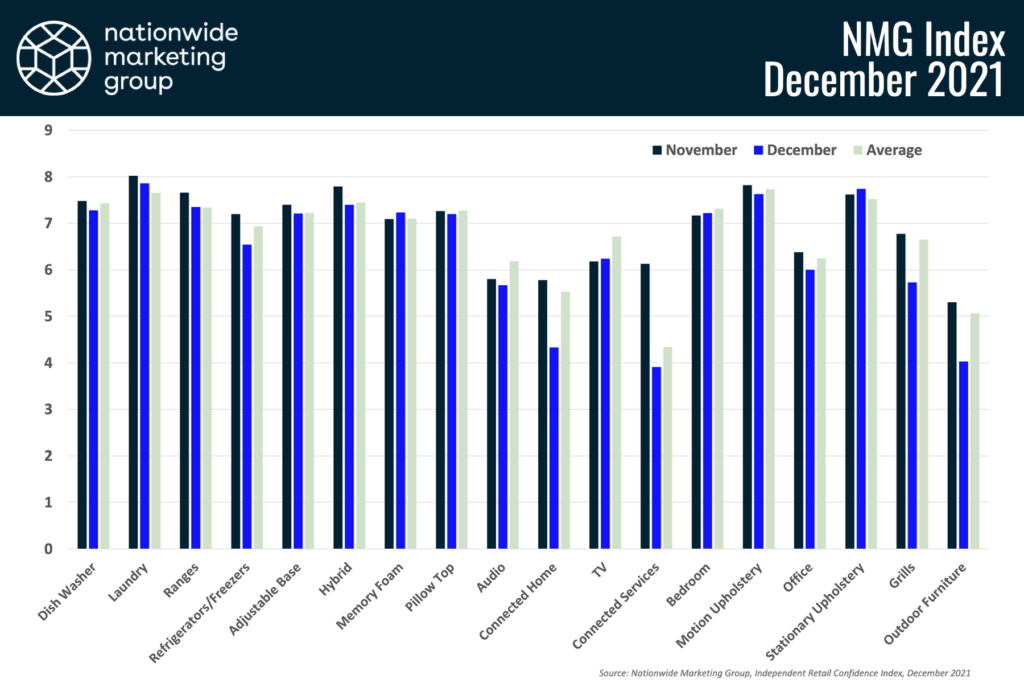

Even as the NMG Index overall declined last month, confidence levels across the 18 product categories Nationwide surveys for remained very strong. This month, as traffic confidence rose and the overall sentiment seemed better, it was these product-level confidence scores that ultimately held the NMG Index back.

Each month, retailers score the various categories on a scale of 1 to 10, with 10 being ‘very confident,’ and 1 being ‘not confident at all.’ As the calendar turns to December, the average score across those 18 categories was a 6.48 out of 10 — the lowest average we’ve seen since launching the NMG Index in August 2020.

Looking through the chart above, you’ll see that 14 of the 18 categories performed below their lifetime average this month. The same number of product categories were down month-over-month.

Nothing has drastically changed this month that would cause such a decline in confidence. However, this certainly could be a sign of frustration among retailers with the ongoing supply chain challenges during the most critical portion of the retail calendar.

Strong Sales in October

For all the struggles in overall confidence, retailers had something of a bounce back month when it came to hitting their sales goals.

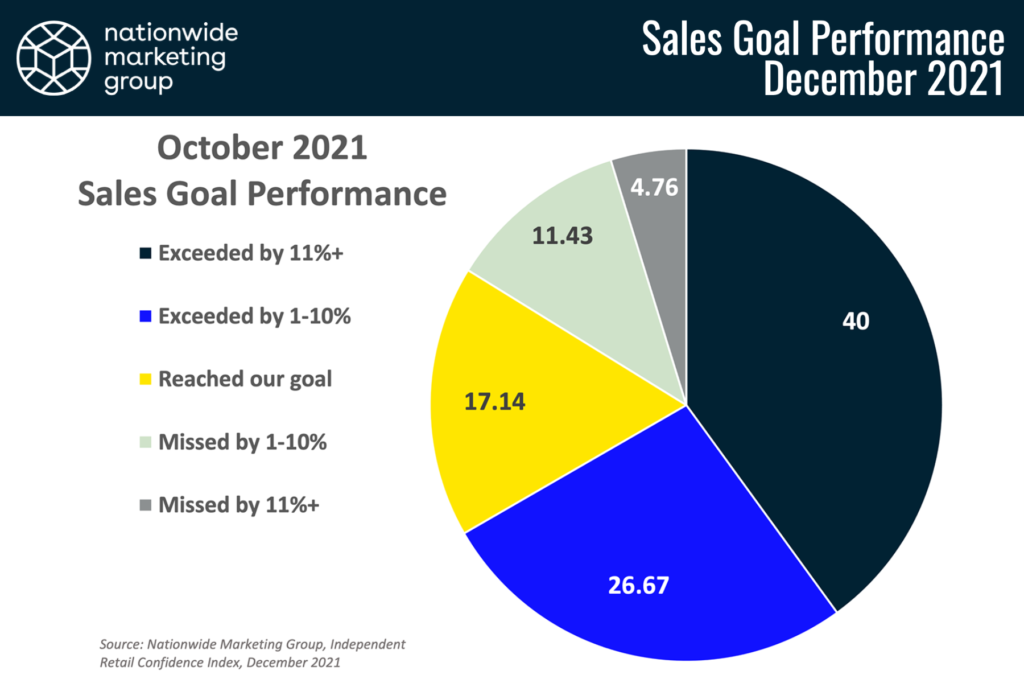

In October, as holiday shopping started ramping up earlier this year, two-thirds of survey respondents said they exceeded their sales goals. That’s up from just over half in September. Additionally, 17% said they hit their sales goals, meaning roughly 84% of dealers hit or exceeded their sales goals — the highest such total since June.

Looking ahead, retailers could see similar, or perhaps even stronger, sales performance in the next few surveys. A number of retailers were already reporting strong traffic and sales performance during the Black Friday holiday shopping weekend.