You could almost feel the collective eye-roll coming out of Wall Street this week after the U.S. Bureau of Labor Statistics shared its August 2022 inflation report. The BLS’s Consumer Price Index showed overall year-over-year inflation at 8.3 percent, up 0.1 percent month-over-month despite the fact that gas and other energy prices continue to fall. Economists were anticipating a decline of 0.1 percent.

The news sent the stock market for a whirl as this report is the last the Federal Reserve will see before its meeting later this month where it’s expected to deliver its third straight 0.75-point interest rate increase. Economists also expressed concern that the latest CPI report could result in the Fed continuing its aggressive approach in the fight against inflation for longer than anticipated.

None of this is new news to the independent retail channel as we see the economy continue to correct itself coming out of the pandemic.

While the people in suits continue to analyze and predict what the other people in suits will do to combat inflation, new consumer research sheds some light on how Americans plan to weather the ongoing financial storm.

The first report looks at changes consumers have already made in terms of household spending in the past six months, which included the typically busy summer months. There, Insider Intelligence and eMarketer learned of the cost-cutting methods U.S. adults are taking across the board. Specifically:

The first report looks at changes consumers have already made in terms of household spending in the past six months, which included the typically busy summer months. There, Insider Intelligence and eMarketer learned of the cost-cutting methods U.S. adults are taking across the board. Specifically:

- 65 percent of consumers said they spent more on groceries and less on experiences

- 59 percent said they dined out and traveled less

- Consumers started saving more in order to have a safety net (43 percent) or for future indulgence (38 percent)

- 33 percent postponed a planned major purchase, things like a new car, home or renovation project

- 30 percent canceled online subscription services, and another 29 percent canceled online streaming services

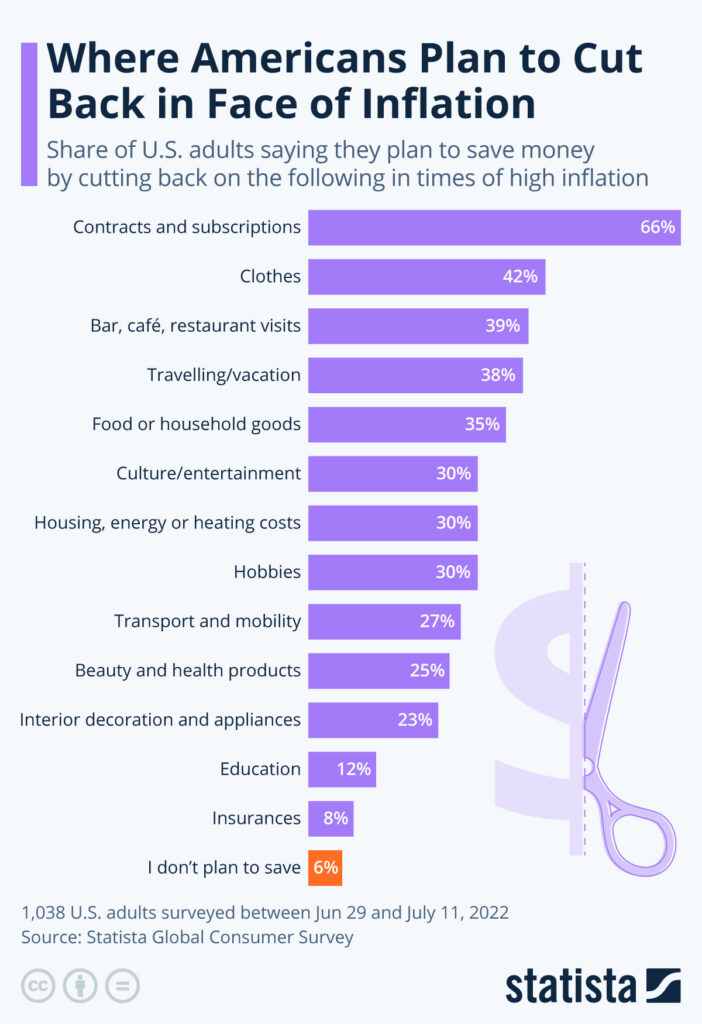

So, what are consumers’ future spending plans as inflation continues to remain high? A recent Statista global consumer survey (chart to the right) offered some predictable findings in that regard:

- 66 percent of consumers said they plan to cut back on contract and subscription services

- 42 percent said they will spend less on clothing

- 39 percent will make fewer bar or restaurant visits

- 38 percent said they will cut back on travel or vacation spending

Further down the list, 23 percent of consumers said they’d cut back on interior decoration and appliances purchases — assuming those are non-duress purchases, of course.

Retail Data Tells a Different Story

Despite the planned cutbacks in spending, monthly retail data from the U.S. Census Bureau paints a slightly different picture than the one offered up by the two consumer surveys. In its latest monthly report for July 2022, the $682.8 billion in total food and retail sales for the month were more than 10 percent higher than July 2021. Further, the period from May 2022 through July 2022 shows retail sales were up a little more than 9 percent compared to the same period from a year prior.

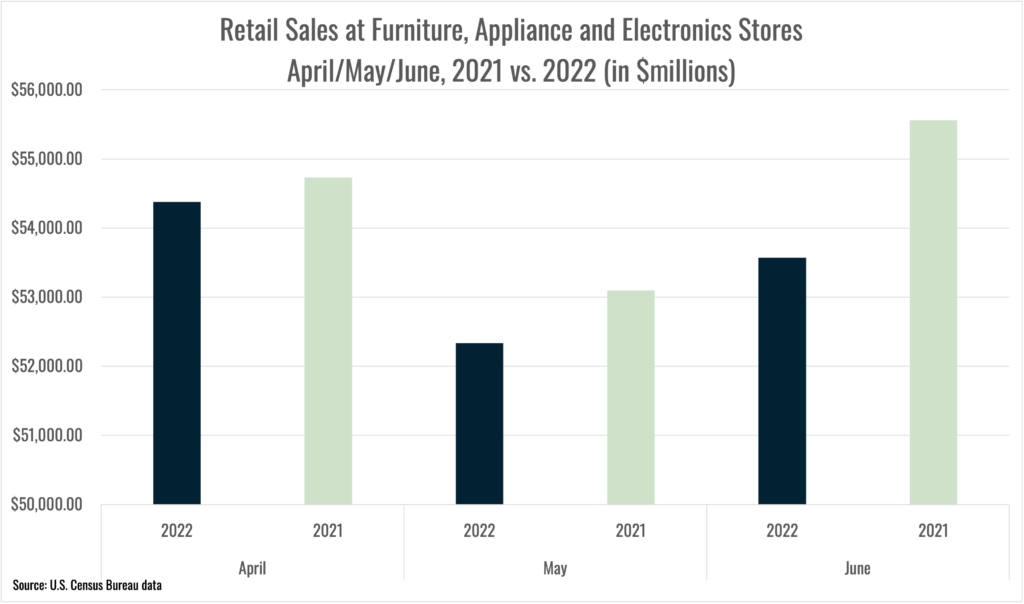

Using the Census Bureau’s most recent data, we looked closer to find sales data for home appliance, furniture and bedding and consumer electronics stores. While down slightly, year-over-year, the period between April and June 2022 vs. 2021 wasn’t as drastic as the consumer research would have you believe. Total sales among those store types in April 2022 was $54.38 billion (down 0.7 percent, year-over-year), $52.3 billion in May 2022 (down 1.4 percent, year-over-year) and $53.57 billion in June 2022 (down 3.6 percent). So, the slowdown in spending is happening, for sure. But these categories are still holding their own.