If you’re someone who doesn’t react well to negative news or economic analysis, I’d strongly suggest you stay away from all of the doom and gloom floating around the financial sector right now. Economists, analysts and article comment sections are all having a moment while inflation continues to run high — despite the Fed’s work to tame it via frequent and steep interest rate hikes. Of course, you’ll still have to walk the aisles of the grocery store and drive by the gas station every now and then.

Despite the economic uncertainty, one fact remains: We’re in the thick of the holiday shopping season, which is perhaps the most important 10-to-12-week stretch on the retail calendar. And, with that being the case, what can independent retailers expect from consumers who’ve seen their budgets tightened this year?

Recent retail data offers a few suggestions as to how the holiday shopping season could shape up. So, let’s dive into it.

Consumers Are Still Spending

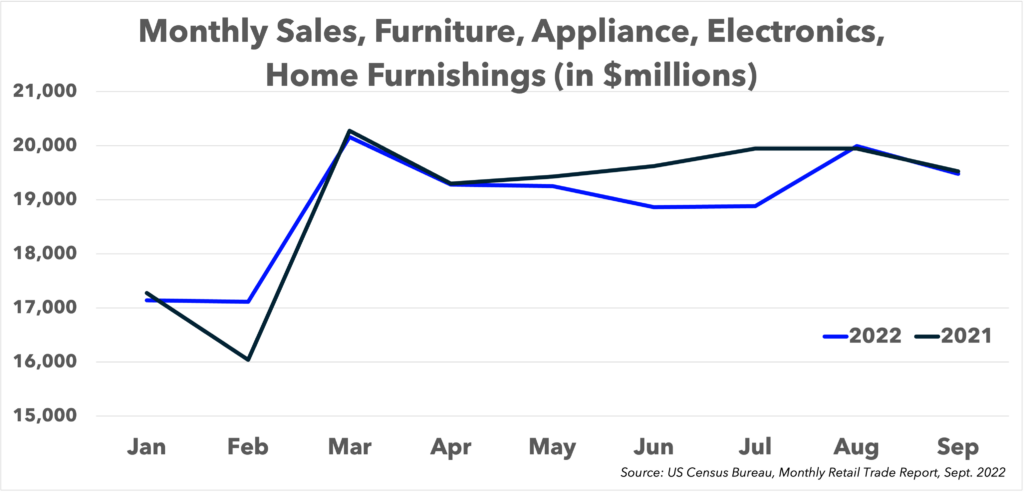

Simply put, consumers are still spending even though inflation remains elevated. Looking at recent U.S. Census Bureau retail data for the categories important to the independent retail segment, consumer spending has been essentially tracking right in line with last year. Through September, consumers have spent roughly $170.2 billion across the home furnishings, furniture, appliance and consumer electronics categories this year. That’s down 0.7 percent from the $171.3 billion spent over the same stretch last year.

Of the categories we tracked, consumer electronics has seen the biggest hit this year. The category was down 9 percent in September, and it hasn’t seen a year-over-year growth in any month since February. Nationally, the final few months of the year, which tend to be when the CE category thrives, could end up being a challenge.

Looking at Nationwide’s own PriMetrix data, though, the CE category has performed markedly better at the independent retail level. According to NMG’s data, Q3 sales were up over 710 percent compared to the July-to-September period last year. Further, independent retailers pushed roughly 225 percent more product out their doors during Q3 2022 than they did last year.

Collectively, the retail industry saw nominal growth month-over-month, up 0.4 percent from August. But spending outpaced last year by 9.4 percent, and it was up 9.2 percent on a three-month moving average compared to the same period last year.

“September retail sales confirm that even with rising interest rates, persistent inflation, political uncertainty and volatile global markets, consumers are spending for household priorities,” NRF President and CEO Matthew Shay said in reaction to the latest retail report. “As we enter the holiday season, shoppers are increasingly seeking deals and discounts to make their dollars stretch, and retailers are already meeting this demand.”

The question becomes, then, where is this money coming from? If inflation remains elevated, but consumer spending is still growing — albeit at a slower rate than it has been — then where (or how) are consumers getting the cashflow to support that continued growth?

During a recent call with retailers, a Wells Fargo economist pointed to the fact that consumers are saving less than at any point over the past few years while also leaning more heavily on available lines of credit. To the latter point, consumers added $17.1 billion to their credit card balances in August, up 18.1 percent compared to last year.

What’s All This Mean for the Holidays?

Bottom line, the holiday shopping season is already underway. Consumers have been very conscious of the fact that inflation is pushing the cost of product (and presents) higher this year, which means they’ve been doing what they need to, to spread out the cost of the shopping for the holidays.

In addition, it means they’re likely going to be cost conscious around what they’re buying and will look to scout out the best deals on certain product. Analysts also project that this holiday season will be highly promotional as larger retailers look to offload inventory that they’ve had trouble moving (i.e. Prime Day 2.0, Target’s “early access” deal days, etc.).

Still, as NRF Chief Economist Jack Kleinhenz noted, consumer demand has remained strong during a volatile period, which should bode well for the holidays. “Households are tapping into savings, accessing credit and reducing their savings contributions as they meet higher prices head on. Shoppers are looking for bargains and value in the current economic environment and even more so as we head into the holiday season.”

Just like the Dr. Seuss character learned, you can’t stop Christmas from coming. And from the way I see it, the American consumer seems poised to grow the financial grinches’ hearts three sizes bigger this year.