The retail industry of today looks lightyears different from what it did just 10 or 15 years ago. And because of the incredibly challenging times we’ve all been navigating thanks to COVID-19, today’s retail landscape also looks quite different from how it did just one year ago when we gathered in Houston for PrimeTime.

Global pandemics and social distancing aside, the retail industry has undergone tremendous change in order to adapt to new shopping habits and customer expectations around the in-store (and online) experience. Today, nine out of 10 shoppers begin their product searches online. And even when they get to a retailer’s physical store, more shoppers than ever before have already researched products, read reviews and compared prices online.

The changing nature of consumers’ shopping habits boils down to two things: convenience and data. Internet shopping — especially in a world where we’re encouraged to stay home — is fast and easy. And during this time, consumers who otherwise might’ve never considered shopping online or taking advantage of things like buy online, pickup in-store (BOPIS) are realizing just how convenient the experience can be.

But arguably more important to the consumer is the fact that they can go on data and fact-finding missions about a product ahead of time. They’ll come to your store armed with customer reviews, price comparisons, professional reviews they’ve watched and more — all before you’ve even had the chance to say, “Hello!”

Shoppers aren’t alone in this big-data journey, though. Retailers who are ahead of the curve have been doing much the same in their own businesses — that is, using data — to meet their customers where they are. And those who are using strong data in the right ways have been able to find ways to better position their businesses for a future of sustained success.

That makes Big Data something every independent retailer ought to understand and know how to leverage. Armed with the right knowledge, you can make strategic decisions, whether that’s about the types of product you carry, the price points you target and so on to ultimately improve your bottom line.

Simply put: There’s no such thing as having too much data, especially in the retail industry. You just need to know how to use that data to your advantage.

“Data provides knowledge, and knowledge, as the saying goes, is power,” says Mike Collier, senior director of retail merchandising for Nationwide Marketing Group. “The more data a retailer has at hand, the easier it will be for them to make a paradigm-shifting decision and feel comfortable about doing so.”

To that end, Nationwide Marketing Group has been on a years-long journey, exploring ways to collect all kinds of data that its members can turn into actionable initiatives. Together with a large segment of Nationwide members who supply point of sale (POS) data, the group has collected vast amounts of valuable information that can be sliced and analyzed in myriad ways. The result of those efforts is PriMetrix, the independent retail channel’s first and only performance insights platform.

“Nationwide’s data team has done an unbelievable job over the past few years collecting this data,” Collier says. “But it’s really about what do we do with that data? So, the focus now is on figuring out how to get it back into members’ hands so that they can quickly make decisions that will help their business, their top-line revenue, their profitability and so on.”

It Starts Where It Ends

The crux of Nationwide’s member-facing data initiatives actually begins at the very end of the customer shopping experience with the point of sale system.

“A POS is basically a retailer’s organizer,” explains Steve Mahler, director of POS for Nationwide. “Consistency is always key for a retailer, and so it’s important that their POS manages every aspect of their business. Everything from delivery, to a promotional giveaway sponsor, to damaged items discovered, right down to shipments received.”

POS data for the individual retailer is powerful in and of itself and can be used to analyze the revenue drivers at the store level, which can help guide a retailer’s buying decisions. But when brought together collectively, among some 14,000 storefronts, the picture of what “Big Data” can provide to Nationwide’s members really becomes clearer.

Don’t miss our Independent Thinking Podcast with Steve Mahler on Point of Sale

For many retailers, though, POS data has always been viewed as part of their company’s secret sauce – and they balk at sharing the recipe. To that end, anonymity and protecting members’ data are top priorities for Nationwide. That’s why, the group explains, none of the information is ever shared on an individual basis.

“We’re always encouraging members to participate in the program and reassure them that it’s completely anonymous,” Collier says. “The information is only kept with us. It’s never reported out, other than in a bulk manner, so you’re never seeing one particular member’s information. But the more data that we have, the more solid it is, the more reliable it is, and the better information that we can ascertain from that to share out with all members.”

As a result, Nationwide and its members are able to use the collective data to do things like leverage vendors for better programs and net pricing deals, measure and refine marketing efforts on behalf of the membership, and show manufacturers the data they need to make proper production decisions, ultimately leading to increased stock of the best-selling models for the independent retail channel.

The Assortment Rationalization Tool

While it’s easy to talk about compiling massive amounts of data with the theoretical benefits it can provide, finding ways to actually produce a product or tool that can provide analysis that retailers can act upon quickly is a bit of a unique challenge. But it’s that very challenge that Collier and the Nationwide data team were tasked with solving.

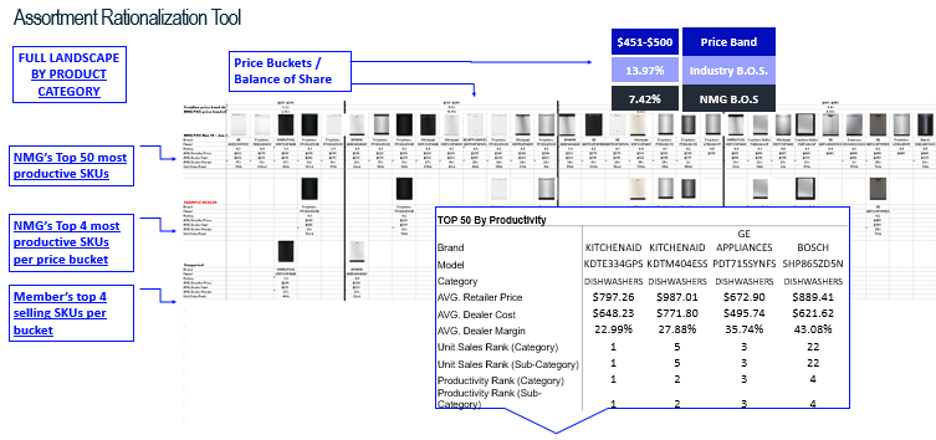

What they came up with, after months of fine tuning, was the Assortment Rationalization Tool, or ART for short.

“Ultimately the end game is to make our members more profitable,” Collier says. “We’re excited about this tool because it doesn’t exist out there anywhere else. And that goes to all the data that we’ve collected for years, and continue to collect, that enabled us to build a tool like this to help our members. We’re incredibly excited about the possibilities here with ART.”

When a retailer accesses ART, they’ll find a streamlined breakdown of the six major appliance categories — refrigeration, laundry, electric cooking, gas cooking, dishwashers and freezers — along with 21 subcategories like French door refrigerators, top-freezer refrigerators, upright freezers, freestanding smooth-top electric ranges, gas cooktops and more. Collier says that while the tool is currently only focused on appliances, expansion into other verticals is already being discussed.

Learn more about ART in our Independent Thinking Podcast with Mike Collier

When a retailer logs onto ART, they see a customized analysis for their own store based on sell-in (shipment to Members) and sell-thru (that POS data) volume that shows:

- Balance of share, or the percentage of units sold in various price bands

- The top-50 most productive SKUs for each of the 21 subcategories (productivity rank as measured by metrics like number of sales floors a SKU is displayed on, unit sales, margin dollars, margin percent, sales trends and number of Members who buy a particular SKU)

- Nationwide’s top-four most productive SKUs in each price band

- The specific retailer’s top-four selling SKUs for each of the 21 subcategories

With a quick glance into the ART platform, a retailer can see how their assortment is performing compared to both the broader Nationwide membership and the independent channel at large.

“We can easily and quickly see, what is the market really asking for? What is the customer looking for, either at our price point or by brand, or by a combination of both, and what are we missing?” says Ben Willis, a sales and merchandising executive at Charlotte, North Carolina,-based appliance retailer Queen City Audio Video Appliances. “The scope of this allows us to really broaden that and say, ‘Okay. How many different brands are out there? How many different models really play in this price point?’ I didn’t even consider that, or I hadn’t even known about that, or we’re playing here and the market’s really playing here. I’ve got to rethink a little bit of my strategy.”

Though they’ve only had access to the tool for a few weeks, Willis and his team are already making strategic merchandising decisions based on what data ART has presented to them.

“It’s given us an idea that there are obviously some other brands in the market that were better players than we expected them to be, quite frankly,” he says. “Having some of that knowledge gives us a better understanding of, are we prepared to either compete with that product or do we need to bring that product in from an assortment standpoint? In the past, you’d spend some time analyzing and going through notes, going through orders, going through a year-over-year analysis. Now, I can look at that information succinctly and make quicker decisions.”

Moreover, Willis says that being adept at using and understanding ART leans into the competitive advantage that the independent retail has over Big Box stores, and that’s their ability to shift on a dime.

“We can make a change quickly. We’re the speedboat. We’re not a cruise ship,” he says. “We’re not going to create this huge, massive wake that takes forever to get around. We can make a cutoff at the pass using this tool.”

A Paradigm Shift for Retail

Where ART may hit home for most retailers, though — and especially those who’ve been in the business for a number of years — is how the tool has the ability to fundamentally change the way merchants do their jobs.

Take appliances out of the picture and think about life as a buyer in any category for any type of retail store. In the past, the way a store was merchandised was likely determined by what the buyer gravitated toward. There might’ve been some analysis of which products customers purchased most frequently. But really it all came down to gut feelings or what types of product that individual simply preferred. ART essentially replaces those “gut feelings” with hard data. Questionable calls on a certain line become fact-based decisions grounded in hard, indisputable numbers. What’s more, ART is just in its infancy. As retailers dive deeper into the tool, they’ll inevitably find ways to use ART that raise more questions — questions that additional data and analysis can provide answers for.

Armed with data, and guided by the proper tools and implementations, independent retailers today have an opportunity to not only adjust their business models in order to meet the needs of their customers — they also have the opportunity to stand out as innovators and pioneers among their peers.

“We’re committed to evolving our data initiatives and continuing to add more value for our members,” Collier says. “That’s all we’re all trying to accomplish — providing the maximum amount of value to our members. We succeed only when they succeed.”