Consumers shop differently today; it’s as simple as that. Sure, in-store purchases — especially in the appliances, furniture and bedding segments — currently outweigh their online counterparts. But the scale is slowly tipping. That’s to say the in-store experience is becoming less relevant — we’ll continue to beat the brick-and-mortar drum. But, at the very least, without giving consumers the option to make purchases through your website, it’s possible that you’re leaving potential sales on the table or losing them to the big box competitor down the street.

Today, it’s all about simplicity from the consumer’s point of view. They want to be able to search your website without having to overthink. They want to know the key features of a product without having to dig deep. And, when the time comes, they’ll want to purchase that product without having to get up and look for their wallet.

To that last point, eWallet (or digital wallet) providers like PayPal, Apple Pay, Google Pay and Amazon Pay have made the online checkout process a breeze for e-commerce shoppers. With a simple tap of a button and a fingerprint (or FaceID) scan, they purchase is made. No need to enter 12-digit card numbers, expiration dates or CVV codes. And, in most cases, those eWallets will also store the customer’s preferred shipping and billing address, which cuts the checkout process down even further.

When it comes to the balance of share in the e-commerce checkout realm, eWallets already lead the way by a wide margin, according to Statista. Last year, mobile wallet checkouts accounted for 49 percent of all e-commerce transactions worldwide. Credit cards represented 21 percent of all transactions, and debit cards tallied another 13 percent. So, even combined, credit and debit card purchases online still were outpaced by the eWallet purchases.

Looking a little closer at the eWallet world, there’s currently one brand that’s leading the way in that space — PayPal.

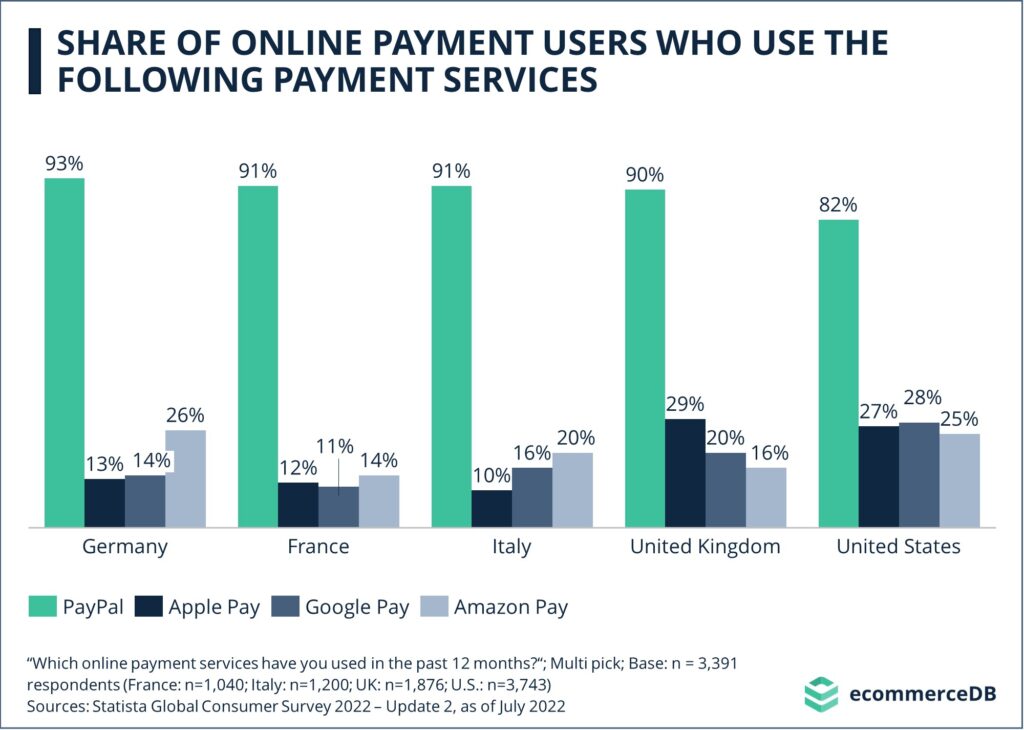

A recent Statista Global Consumer survey found that the share of online payment users who use PayPal greatly outweighed the other major services. In the U.S., 82 percent of consumers report using the service. Apple Pay, Google Pay and Amazon Pay were used by 27 percent, 28 percent and 25 percent of consumers, respectively. Elsewhere around the globe, PayPal was used by at least 90 percent of users.

It’s definitely worth noting that, here in the U.S., consumers are more comfortable with a variety of the major eWallet providers than those in other global markets. A sign that, even with PayPal leading the way, the other services are viewed as valuable by consumers.

Interested in learning more about Nationwide Marketing Group’s program with PayPal and how alternative payment methods can help drive additional sales for your business? Get in touch today!