Demand for home appliances in any given year can be influenced by a number of different factors, but there are certainly a few key contributors, including but not limited to the economy, consumer replacement cycle and technology advancements. One thing that is certain, though, is the ongoing necessity for appliances in nearly every American household. And that need creates opportunity for your business and the Independent retail channel to serve as the preferred shopping destination for consumers.

Let’s look at what occurred in 2019 and how 2020 might shape up for the category.

State of the Industry

Source: U.S. Census Bureau & National Association of Realtors

Starting with the economy; home appliances was a relatively healthy category, but it was not without some turbulence over the course of the year.

One of the biggest concerns continues to be the imposed and potential increased impact of tariffs as a result of the U.S. and Chinese governments’ continued trade dispute. While the first round of tariffs went into effect Sept. 1, it left the balance of Q4 with unpredict- able and fluctuating price increases. Up to this point, most manufacturers have worked hard to offset tariff pressure through increased efficiencies and product cost improvements, but the unknown outcome remains a risk to further cost increases.T

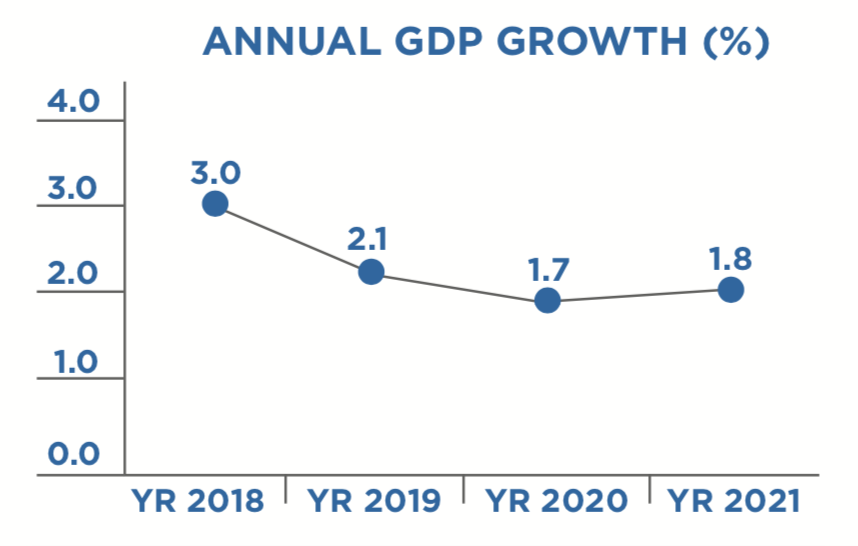

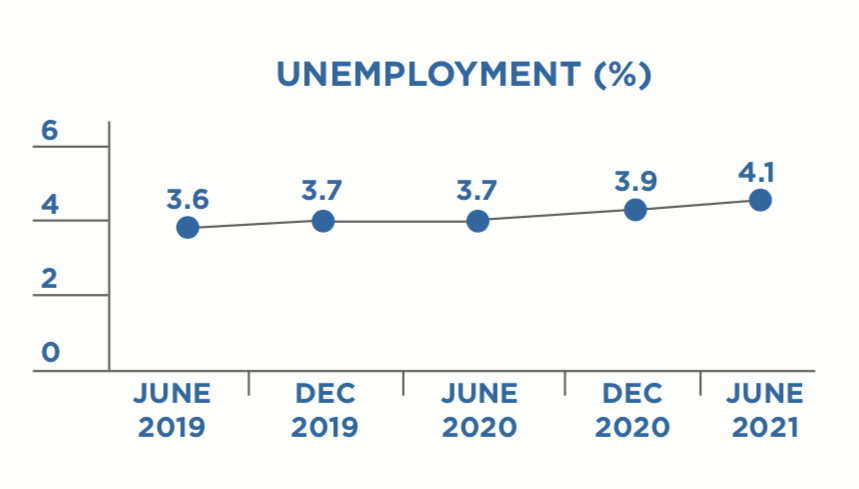

Setting tariffs aside and turning to other economic indicators, the annual GDP ended 2019 at approximately 2.1%. Economists expect a slight downtick in 2020 to 1.7% with stable inflation, while unemployment will remain near record lows (see figures A and B in the next column). The housing market has yielded mixed results thus far, as the home ownership rate of 64.2% was virtually unchanged YoY and existing home sales are down approximately 7% YTD. However, sales of single-family homes rose 4.5%, and inventory dropped 4.8%. To tie this all together, we saw shipments end the year down approximately 2.5% (AHAM).

Source: U.S. Census Bureau & National Association of Realtors

So, where does all of this leave the home appliances category going into 2020?

Trends & Outlook

As forecasters project another flat-to-slightly-down year in overall appliance shipments, there remains tremendous opportunity for the year ahead.

Let’s begin with Sears and the continued erosion that has occurred with the 100+ store closings in the second half of 2019, which will ultimately reduce their continued share loss to less than 10%. It’s expected that they’ll hit rock-bottom, single-digit market share in 2020. Sears’ demise will continue to pour more consumers into the market who are looking for alternatives and who tend to skew toward the Independent retailer demographic. These consumers tend to purchase a more premium mix of products while also utilizing consumer finance credit programs.

I also believe the appliance business is closing in on embracing the fast-paced connected home category.

More and more appliances today come to market with smart features embedded in them. This evolution into the connected age will begin to divide retailers who have the capability in employee talent and experience to win in this environment.

This is where I see Independent retail — and possibly Best Buy — leading in this space, leaving the lumber yards and clubs on the outside looking in. Consumers will begin to look and ask for help on new technology features, and if you don’t have an educated staff and in-store experience to deliver on this, you’ll lose the consumer dollar.

With the launch of Nationwide’s connected home division in the second half of 2019, we’ve tasked ourselves with finding a way to help Members leverage all of our assets — including but not limited to AT&T, our Google hardware relationship and new prospect service providers — to win in this space.

Lastly, the industry may experience some balance of share shift as the Korean brands look to continue making a mark in the appliance space, and there’s the possibility of new emerging brands entering the U.S. market. Whirlpool, GE and Electrolux will also look to keep pace and grow in the year ahead with new and innovative products coming to market.

No matter what changes occur in 2020, one thing is for sure: the team at Nationwide Marketing Group will continue to work tirelessly for your success. I’m incredibly honored to serve you and this channel and thank you for allowing our organization the opportunity be a part of your bright future!