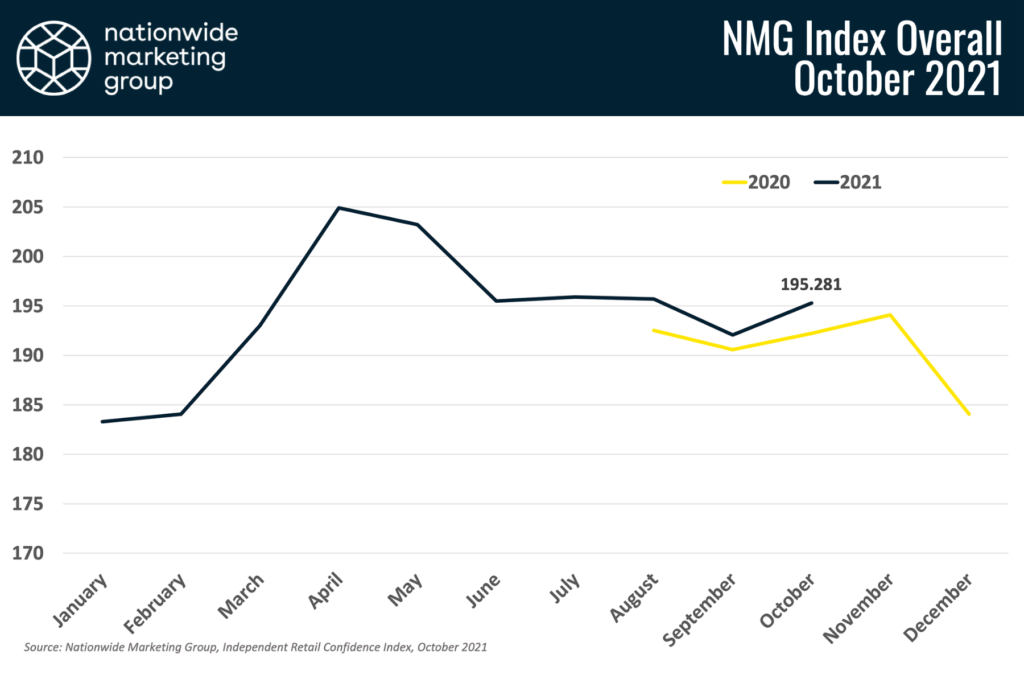

As the retail world enters the all-important final quarter of 2021, the independent channel saw its confidence jump up just over 3 points to 195.281 (69.5%) in October, according to the latest Nationwide Marketing Group Independent Retail Confidence Index survey. The gain heading into October matched a similar trajectory seen last year and helped the channel’s confidence remain above 2020 NMG Index levels for the third month in a row.

As in previous months, retailers pointed to the catch 22 that they seem to be inherently stuck in as the catalyst for the confidence level. The industry seems to be on a teetering seesaw that could easily tip one way or the other depending on certain factors. Strong demand and continued consumer spending has the potential to swing confidence much higher than it currently is. However, inventory challenges and supply chain constraints limit retailers’ ability to have a completely rosy outlook on the business.

“We’re seeing continued sales that exceed our projections for all of 2021,” said one retailer. “I don’t think it will change. However, consumers are becoming more impatient regarding product availability so if manufactures cannot keep up with the demand and fill orders, buyers will go wherever they can to get the goods.”

Another retailer explained their current confidence level by stating bluntly, “We will exceed our sales goals if we receive inventory. However, II do not believe suppliers will meet deliveries as expected.”

It goes without saying, the final quarter of the calendar year is the most important three-month stretch for the retail industry. Traditionally, the holiday shopping season cranks into high gear during this time — perhaps even earlier this year given those supply chain constraints — and two of the single-biggest spending days of the year take place in Black Friday and Cyber Monday.

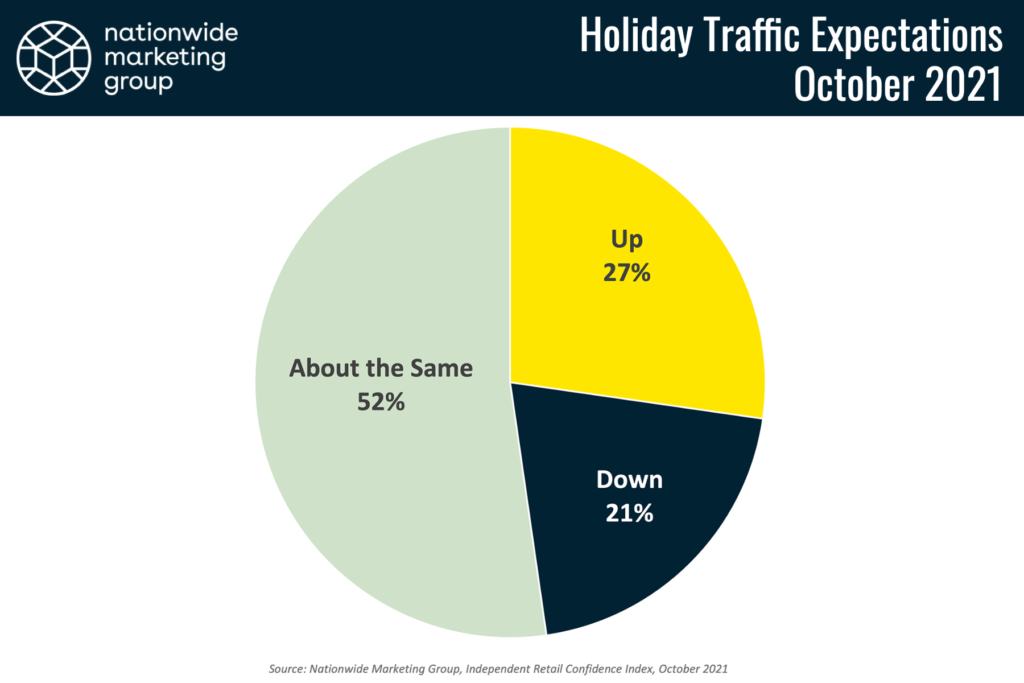

So, how are independent retailers feeling about their foot and online traffic as October gets underway? Well, both were up slightly as the calendar flipped to the 10th month. But we wanted to get a little more specific in our line of questioning. When asked, flat out, how they expect holiday shopping traffic to be at their stores this year, just over 27% of retailers said they think it will be up, another 20% think it’ll be down, and a little over 52% think it’ll be on par with last year.

We asked that question, of course, during a month that is traditionally slow for foot traffic in stores as families’ schedules fill up during the early portion of the school year. So that’s something we will continue to track moving forward.

Record Month for Products

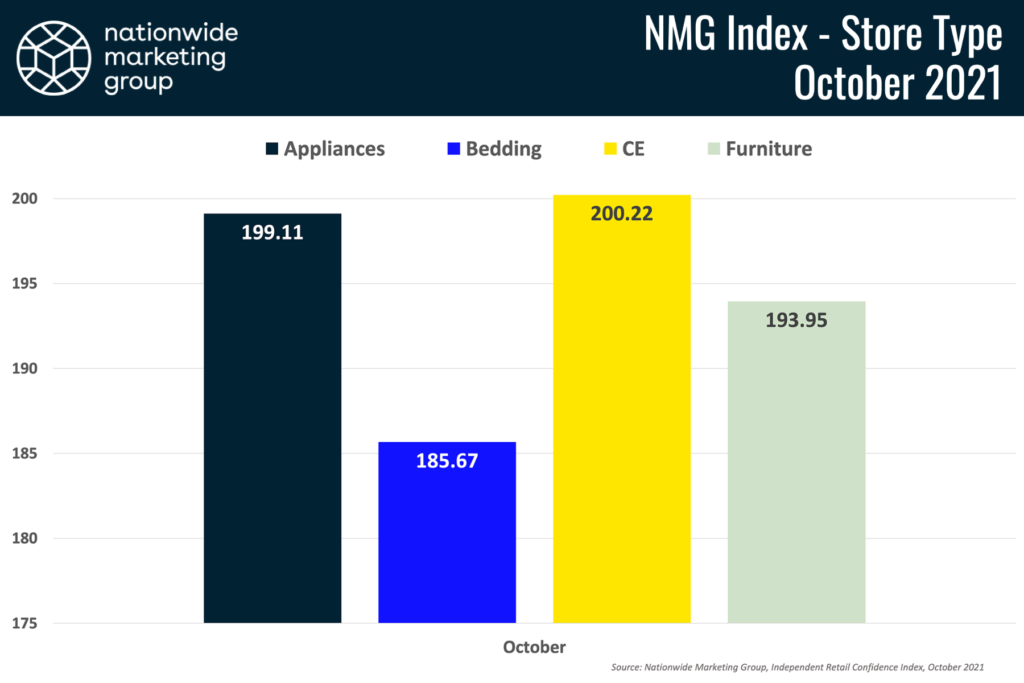

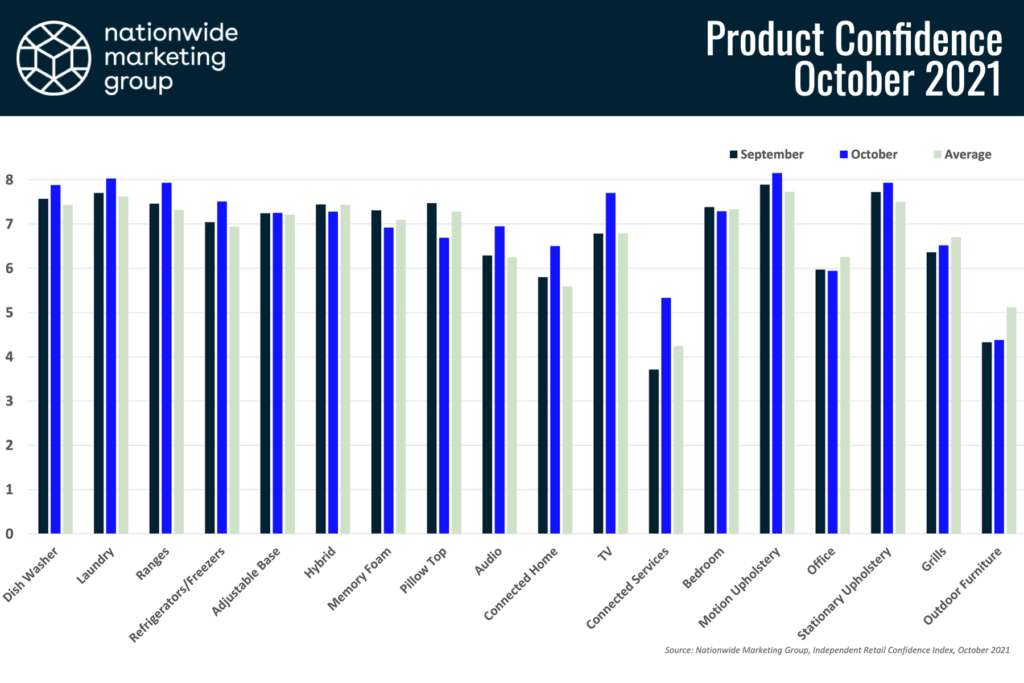

October’s NMG Index score was a return to what’s been considered a “normal” confidence level (the channel has checked in at the 195-point range in four of the past five months). But it turned out to be a record-setting kind of month for our 18 product categories.

Since we began the NMG Index survey back in August 2020, the average monthly confidence score for our products has been within the 6-point range (on a scale of 1 to 10). It’s gotten as low as 6.55 back in October 2020, and as high as 6.95 in April of this year.

Then we got to the October 2021 survey. This month, independent retailers broke the 7-point threshold for the first time in the survey’s history, checking in at an average of 7.01 across the 18 categories. Only five of the 18 categories were down month-over-month, and those that were up, were up big.

Notably, Connected Services was up over 1.6 points month-over month and up over a point on its lifetime average. That’s probably not a major surprise during a month in which Apple and Samsung both launched new smartphones. All other Consumer Electronics categories were up as well month-over-month and over their lifetime averages — again, not much of a shocker as we head into a traditionally popular time for the tech products of all shapes and sizes.

August Sales Review

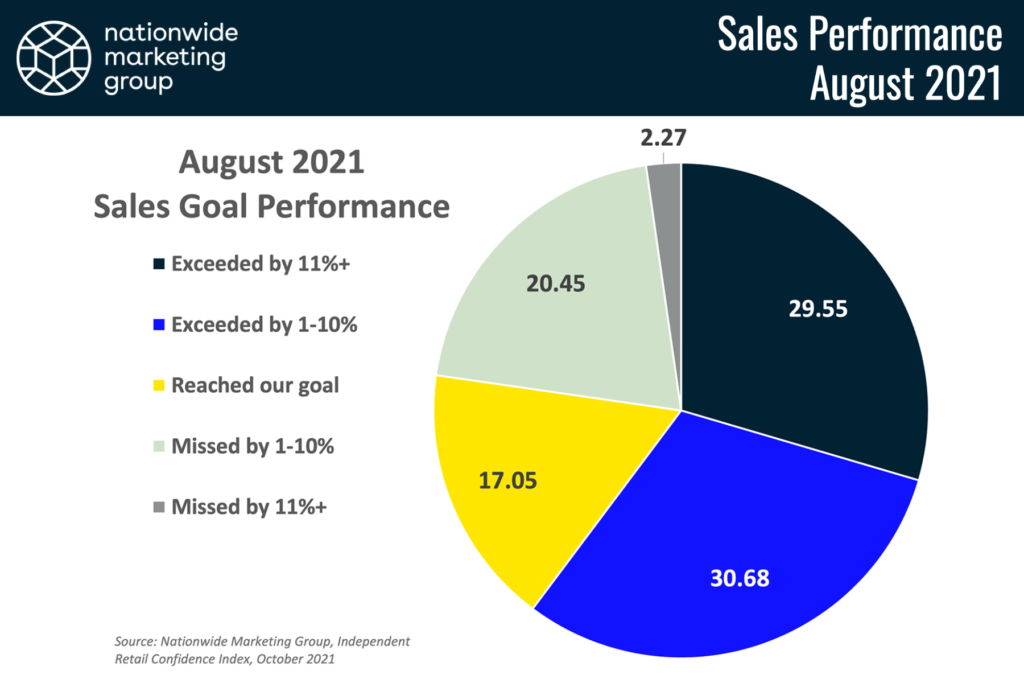

For August, more independent retailers exceeded their sales goals by any margin (60%) compared to July (55%), but a slightly larger portion of the channel missed their goals for the month (23%) than they did the previous month (20%).

Check out the NMG Index archive for previous survey reports. Interested in signing up to take the NMG Index survey each month? Fill out our signup form.