As we turn the page on 2020, it feels like a fresh start for the global economy. Yet, many of the same challenges that independent retailers faced during the final months of a mostly forgettable year will persist into 2021.

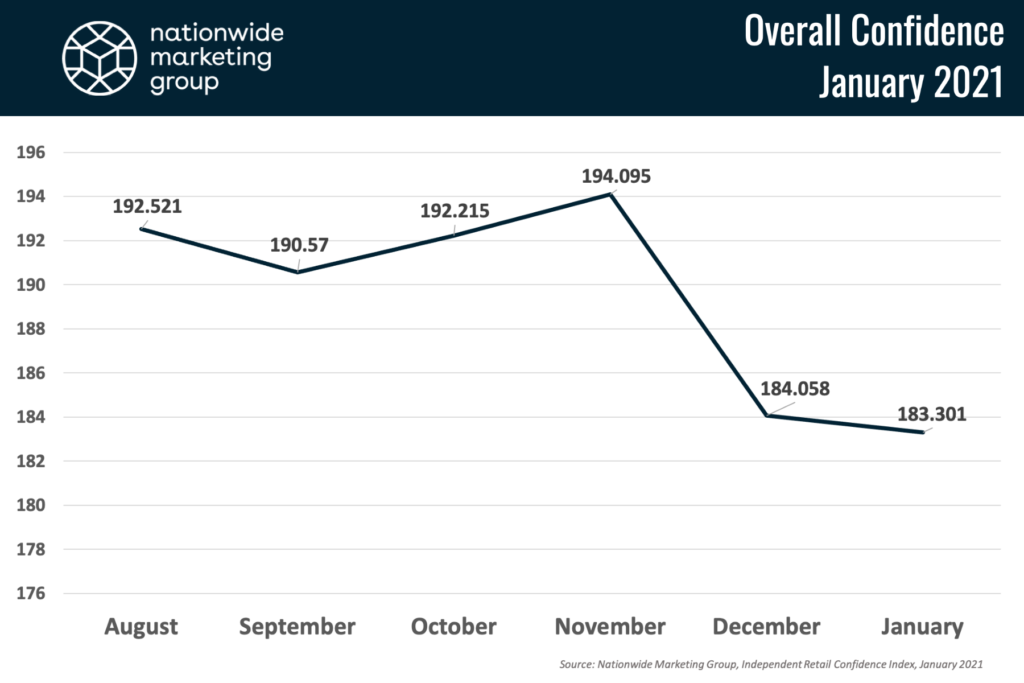

A month after a 10-point dip in the NMG Independent Retail Confidence Index, dealers’ confidence remained relatively flat in January. This first NMG Index of the new year saw retailers check in with an overall confidence score of 183.30, a 0.7 point drop from December. On the percentage scale, confidence was down just a quarter percent to 65.23%.

According to retailers who responded to the latest NMG Index survey, a lot of the same factors continue to impact their confidence level. COVID remains an ongoing — and worsening — situation across pockets of the country. Plenty of retailers are also on edge about the political climate and what a Biden Administration will mean for the economy. In particular, there’s concern over increased social distancing measures and the impact that could have on in-store traffic.

“All indications are that we are continuing the strong current market,” said one retailer. “But with a change in leadership, we don’t really know what will happen.”

Additionally, product availability and supply chain issues continue to be top-of-mind for retailers. Despite reports of strong foot traffic for a majority of retailers surveyed, many point to lack of product availability or long wait times as challenges in closing sales with their potential customers.

Retailers did note an opportunity to convert traffic online this month, though. “I think people are getting used to not going out and shopping,” one respondent said. “January tends to be a cold month, with dreary weather as it is. Adding the spiking COVID numbers, I feel that most of our shopping will be online or over the phone/text.”

Products On Par

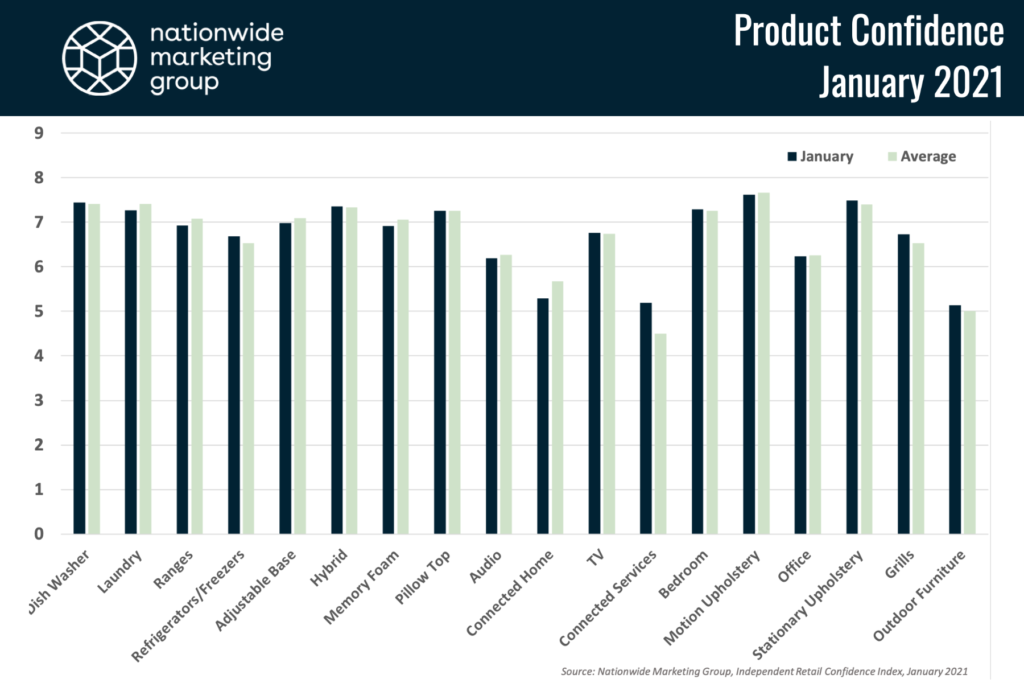

Looking at the individual product categories that the NMG Index surveys for each month, retailers remained right on par with how these products have performed over time. Of the 18 categories that the survey accounts for, 10 recorded scores in January that were above their lifetime average. The biggest game of the month came from Connected Services, which was up nearly a full point over its average.

Strong Sales

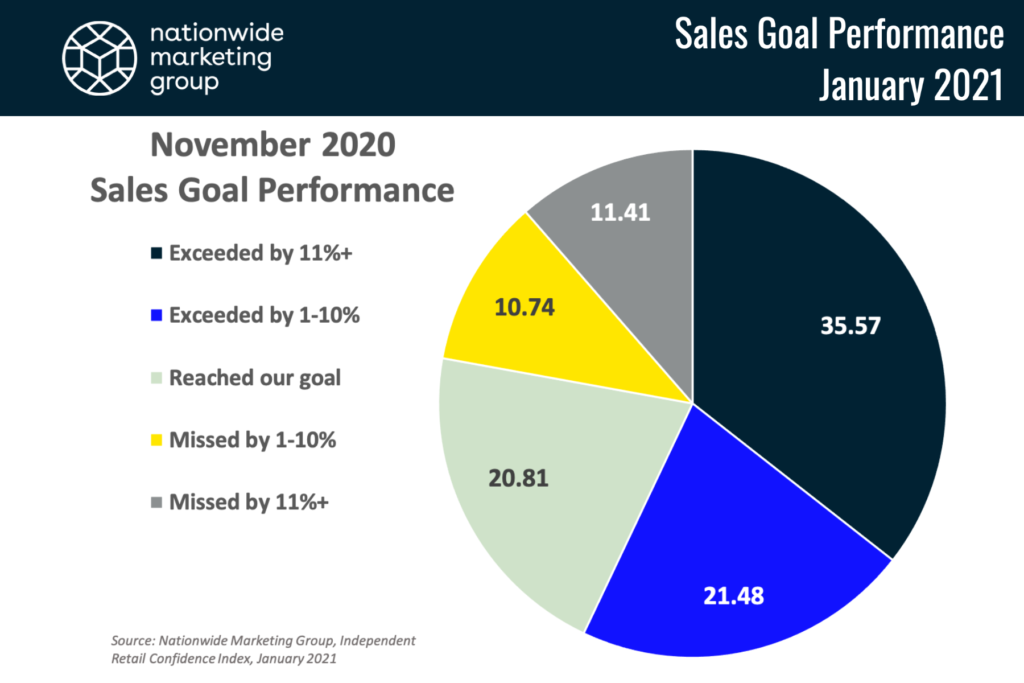

Some of the most interesting data in the ensuing months will come from the sales goal reporting in the NMG Index. While we’ve been tracking confidence levels over the past six months, the sales goal reporting will allow us to go back and see if retailers’ confidence level during a particular month was accurately reflected in how they actually ended up performing. And being able to track that during a holiday shopping season that occurred in the middle of a global pandemic is of keen interest to the team at NMG. So let’s dive into November’s sales goal data.

More than 50% of dealers reported exceeding their sales goals during November — the unofficial start of the holiday shopping season. Another 21% said they hit their mark during the month. That’s a larger portion than in any of the previous surveys, which points to better forecasting on the part of the retailer.

Looking back at the November NMG Index report, retailers saw their confidence peak in November — that was our highest-scoring month to date. That high level of confidence was met with some of the most accurate sales goal forecasting we’ve seen with the NMG Index. And that took place during a month in which a U.S. Presidential election dominated the news cycle for nearly two weeks, inventory challenges persisted, and coronavirus cases began to surge at a high rate.