Just like the rest of life in retail right now, recent reports on economic data and predictions for the coming Black Friday weekend provide us with less clarity than you might hope for. There’s some good news, a little bad news and a general sense that we need to just wait and see what consumers ultimately decide to do during what’s typically one of the biggest (and most important) weekends on the retail calendar.

Let’s get the bad stuff out of the way first.

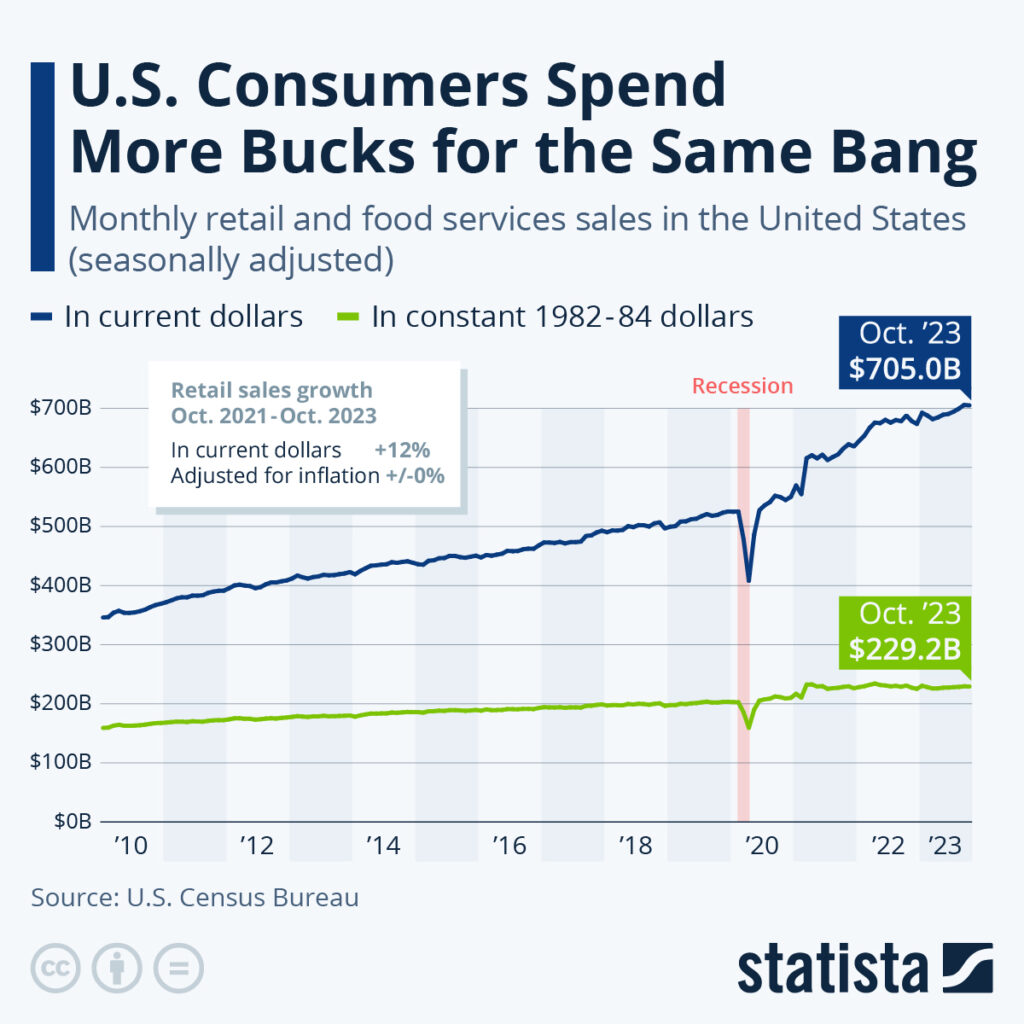

According to the latest report from the U.S. Census Bureau, total retail sales declined for the first time since March last month. Total spending reached $705 billion in October, down 0.1 percent from the previous month but up 2.5 percent from the same period last year. The report noted that, while sales figures have been “surprisingly resilient” in the face of the inflation crisis, it needs to be noted that inflation itself is the main reason why spending is on the rise.

Consumers are essentially getting less bang for the same amount of buck as prices grew 3.2 percent last month. Some quick math, then, shows that the entire 2.5 percent increase in spending compared to last year is entirely attributable to higher prices. So, when adjusted for inflation, spending was actually down 0.7 percent last month, just as it has been in 10 of the previous 12 months, according to Census Bureau data.

In fact, if we look back over the past two years, you’ll see that adjusted sales are almost completely flat if not for the cost of goods going way up.

Enough of that talk, though. Let’s move to the good news.

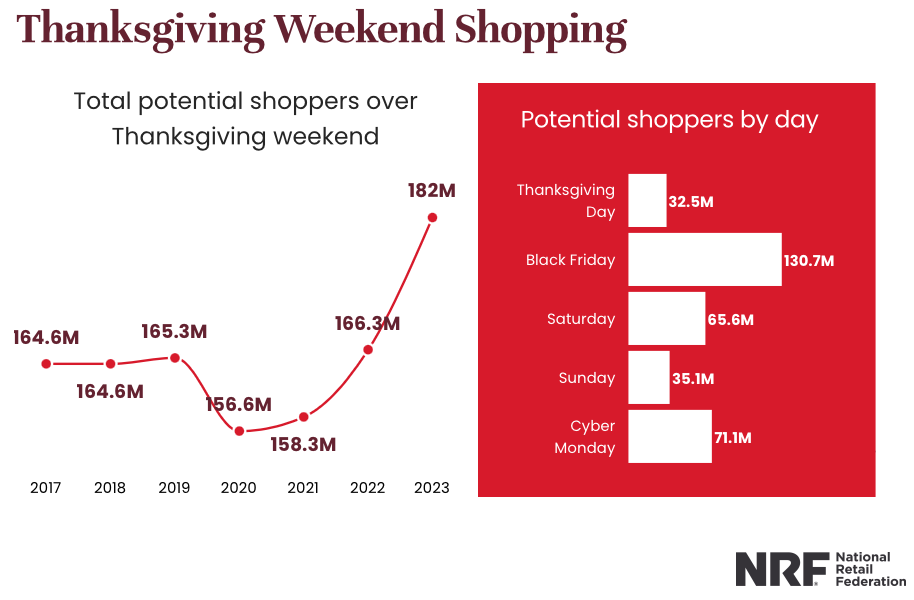

The National Retail Federation released its annual pre-Black Friday report this week, and all signs point to a strong holiday shopping weekend for retailers. According to NRF, an estimated 182 million people are planning to shop in-store and online during the extended weekend – from Thanksgiving Day through Cyber Monday – roughly 15.7 million more than last year and the highest estimate since the retail trade group began tracking this data back in 2017.

Previously, NRF forecasted that spending during the holiday shopping period (from November through December) would increase 3-4 percent compared to last year, totaling some $957 to $966 billion. Online and other non-store sales are expected to account for roughly 28.6 percent of that total, or around $273 to $279 billion, according to NRF – figures that are up between 7 and 9 percent compared to last year.

“Consumers remain in the driver’s seat, and are resilient despite headwinds of inflation, higher gas prices, stringent credit conditions and elevated interest rates,” NRF Chief Economist Jack Kleinhenz said in a statement accompanying the report. “We expect spending to continue through the end of the year on a range of items and experiences, but at a slower pace. Solid job and wage growth will be contributing factors this holiday season, and consumers will be looking for deals and discounts to stretch their dollars.”

Bringing it back to Black Friday, 61 percent of consumers surveyed by NRF said they plan to shop during the weekend event because the deals are too good to pass up. Another 28 percent said they’ll shop because they like to continue the tradition of participating in the Black Friday excitement.

As for potential traffic and participation by day, NRF expects more than 130 million shoppers to head out and shop online on Black Friday, the busiest day of the weekend. That’s followed by Cyber Monday, which should see around 71 million active shoppers. In total, 74 percent of holiday shoppers plan to participate at some point during the five-day holiday weekend this year, according to NRF, which is up from 69-percent in the group’s pre-pandemic survey in 2019. And that’s in spite of the fact that 59 percent of holiday shoppers have already started their gift buying this year.

“The Thanksgiving holiday weekend marks some of the busiest shopping days of the year, as consumers enjoy the tradition of shopping for the perfect gifts for friends and loved ones,” NRF President and CEO Matthew Shay said in a statement. “Retailers have been preparing for months for this occasion. They are stocked and ready to help customers find the gifts and other items they want at great prices during the entire holiday season.”