As the calendar flips to the start of a new year, the Nationwide Marketing Group Independent Retail Confidence Index showed signs that not much has changed in the early stages of 2022 as it relates to independent business owners’ confidence.

Entering 2022, the retail channel — along with every other industry — is again being battered by another variant of the COVID-19 disease. The latest wave and surge of infections has had an impact on foot traffic, which we’ll dive into in a little bit. But many of the same refrains of 2021 have carried over into the New Year, including inventory challenges, backorders and more.

That said, the first NMG Index of the new year did show some positive signs as we enter the third year of doing business under the auspices of a pandemic.

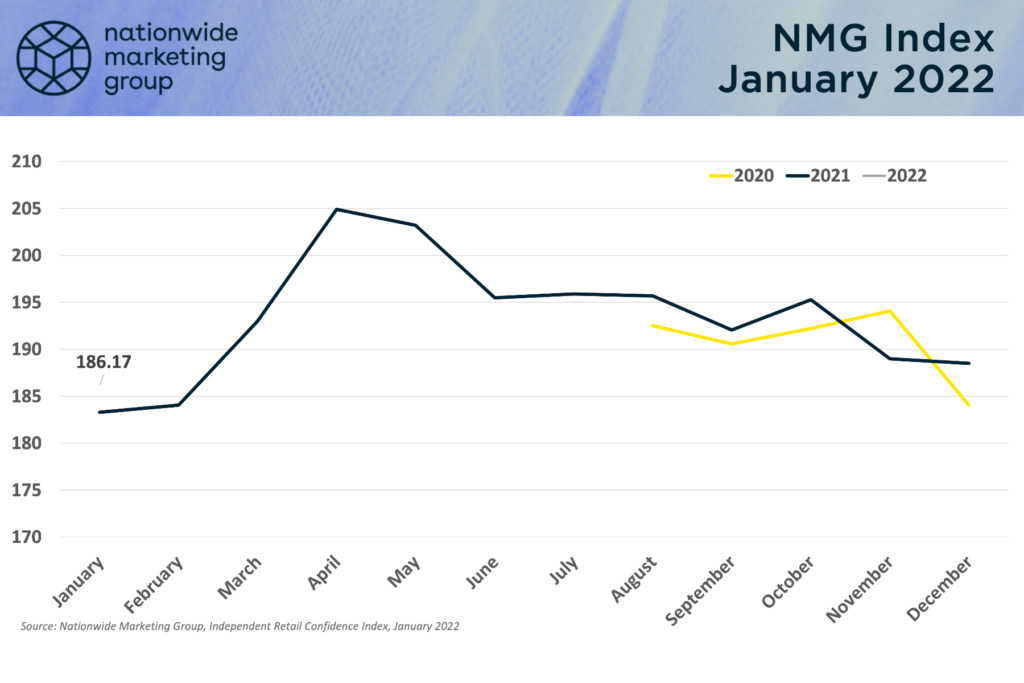

In January, retailers’ responses helped generate an overall NMG Index score of 186.17 (66.25%). While down 2.34 points from December 2021, that confidence score sits roughly 3 points higher than it did a year ago at this time. Since we’ve been able to track year-over-year confidence data, the NMG Index has outperformed Year One in five of six months.

One of the interesting juxtapositions of the NMG Index data is that, while confidence levels have “softened” over the past three months, actual sell through data shows that the independent retail channel is very much healthy. Our retailers even report as much in this survey (see Sales below). There almost seems to be a disbelief among retailers that, almost in spite of ongoing inventory challenges, they can continue to meet consumer demand for their product. Yet, somehow, retailers continue to do just that.

That sentiment shows through in some of the open feedback we received this month.

“We expect revenues to be down from January of 2021, but we also expect to hit the sales mark we have set for ourselves, which is still significantly higher than 2020,” one retailer reported.

Antoher retailer added, “Sales have been outstanding since the pandemic began due to supply issues. By using third-party suppliers like Crosley and our flagship Beko line we have had inventory when most stores don’t. 2021 was the best profit year for us in the last 24.”

Traffic Takes a Not-So-Bad Turn

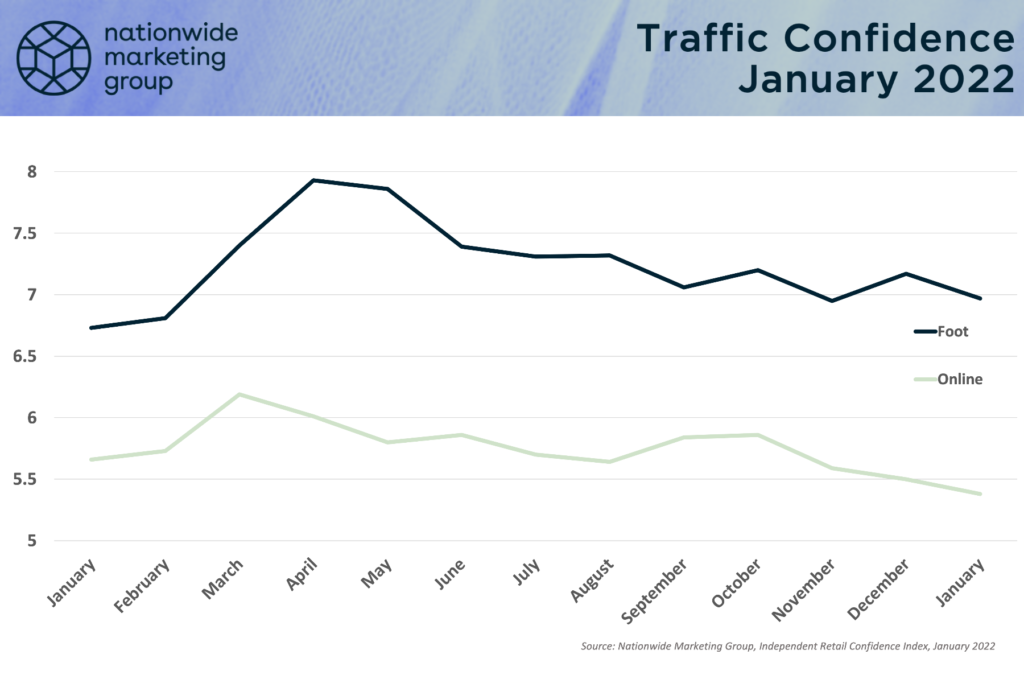

During the winter months, we expect to see a slight hit to traffic for obvious reasons. It’s cold weather across most of the country, which means consumers aren’t going to be leaving their homes as often. Add on top of that the raging Omicron variant and you’ve got the perfect recipe for a solid foot traffic hit.

All of that said, both foot and online traffic confidence levels did decline month-over-month in the January NMG Index, but not as much as we thought they would. Foot traffic confidence declined just 0.2 points to 6.97, while online confidence dropped 0.12 points to 5.38.

On a year-over-year basis, foot traffic levels in January 2022 sit roughly a quarter-point above where they were a year ago while online is down by the same amount.

Products Show Promise

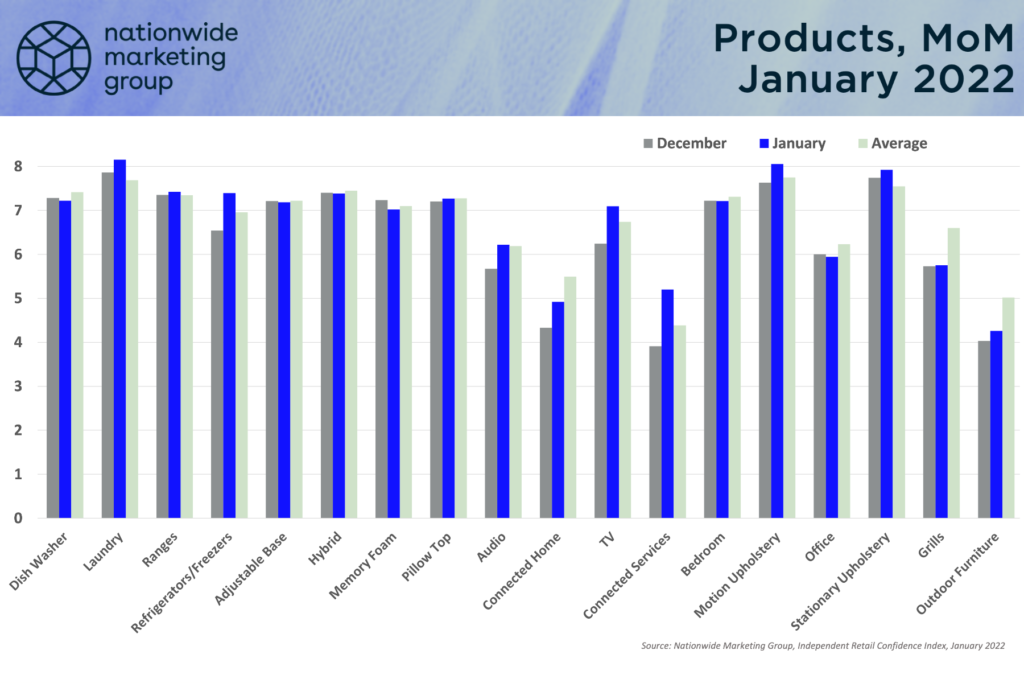

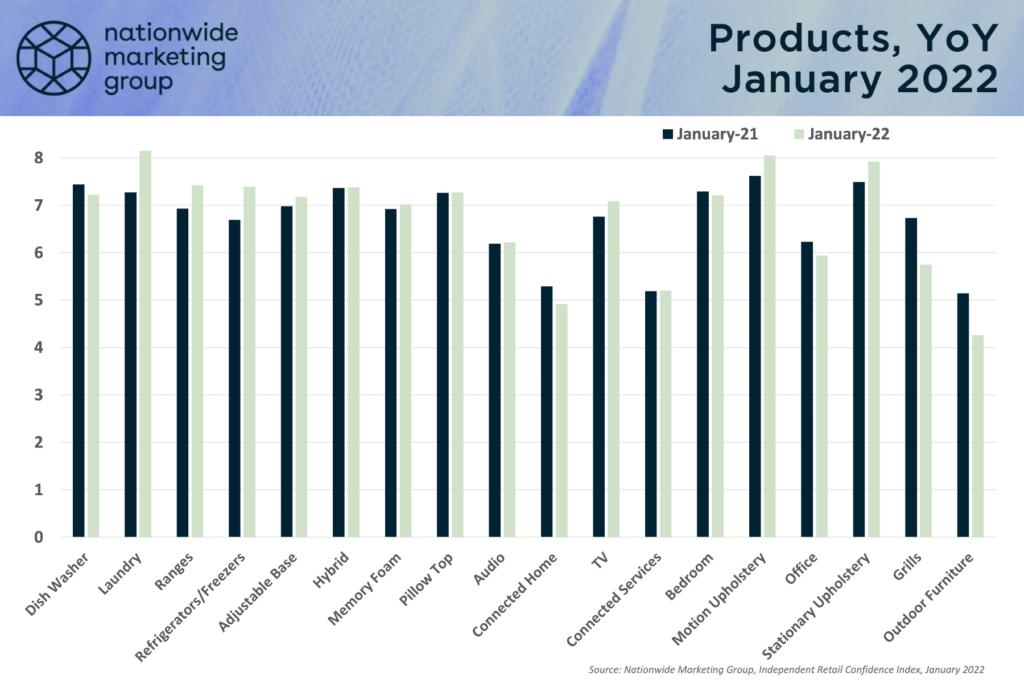

Entering the new year, retailers gave us plenty of positive news related to the 18 product categories that we track confidence around in the NMG Index. The average score among the products in January was a 6.76 (out of a possible 10), which was exactly on par with the average lifetime score for the NMG Index.

Looking month-over-month, 12 of the 18 categories were up while another three scored within one-tenth of a point compared to December’s totals. And even year-over-year 14 of the 18 categories were either up or within that one-tenth of a point range.

Appliance and furniture categories — two of the hardest hit when it comes to supply chain challenges and inventory shortages — were the strongest performing both MoM and YoY in January. That, again, shows that despite the narrative we’re seeing play out in the overall confidence of the channel, retailers believe they can move product and meet demand.

Sales Stay Strong

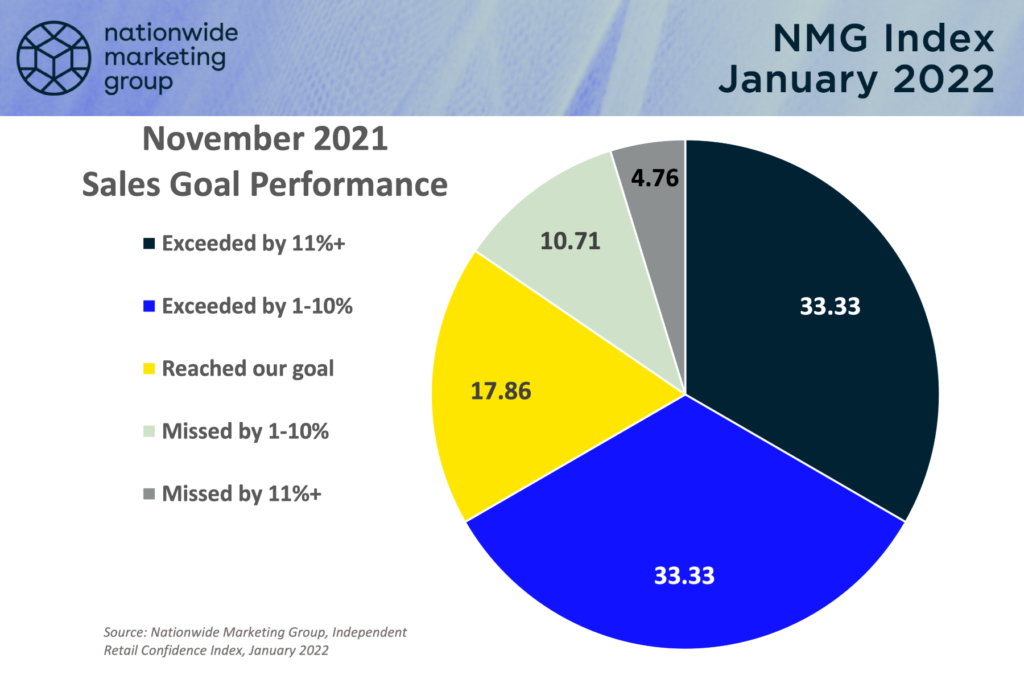

The final three months of any calendar year are always going to be among the most important for retailers for obvious reasons. That makes this continued run of strong performances against sales goals very good news for the independent channel in particular. In November, two-thirds of independent retailers reported surpassing their sales goals. Another 18% said they hit the goal they had set for themselves in the month that included the Black Friday holiday shopping weekend.

Again, the sales goal performance here shows that retailers have been outperforming the “soft” confidence levels that they set for themselves over the past few months. The ongoing challenges and other variables create an outlook mindset that’s been cautious and perhaps a little conservative. But when push comes to shove demand continues to be strong and, for the most part, independent retailers have been able to step up and meet the needs of their customers.

We expect that this narrative will continue through the early portion of 2022.