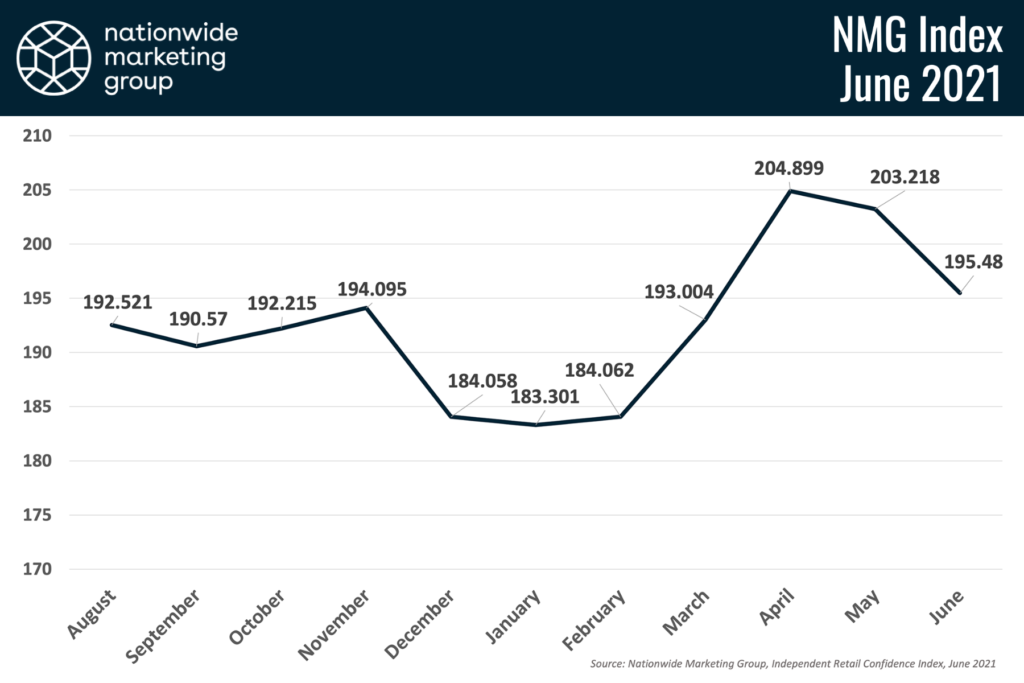

Independent retailers saw their confidence level take a small dip back to more ordinary levels, according to the results of the latest Nationwide Marketing Group Independent Retail Confidence Index survey. Heading into June — a month that includes the official start of Summer, and Dads & Grads season — the NMG Index checked in with a score of 195.48, still good for the third-highest month on record. On the percentage scale, the NMG Index sits at 69.57%, a 2.75-point decline month-over-month.

Not surprisingly, product availability continues to be one of the biggest challenges cited by retailers as 2021 drags on. In some corners of the industry, product is starting to show up, while others continue to see long wait times and growing logs of product on backorder.

“Buyers are plentiful, but inventory is lagging badly and back-order dates from manufacturers seem like moving targets,” one retailer reported.

But that’s just one area of concern among retailers. Elsewhere, retailers seem to be in a sort of catch-22 as it relates to the pandemic. Around the country, local communities are seeking restrictions loosen and economies start to open back up. That’s great news for the whole of life. But some retailers worry this could result in less demand, foot traffic, and overall sales.

“People will be starting to spend more on dining and traveling and entertainment, and this will remove some dollars from furniture,” said one retailer.

It should be noted that the increase in travel is viewed differently depending on where a retailer is located. Plenty of retailers expressed concern over their customers heading out of town. But several dealers in high-traffic tourist areas realize the opportunity afforded to them as consumers return to the roads and skies.

Also of concern is the fact that government stimulus money, which has been provided a major boost to the retail industry over the past year, is quickly drying up — and it doesn’t look like any additional rounds are being floated through Congress.

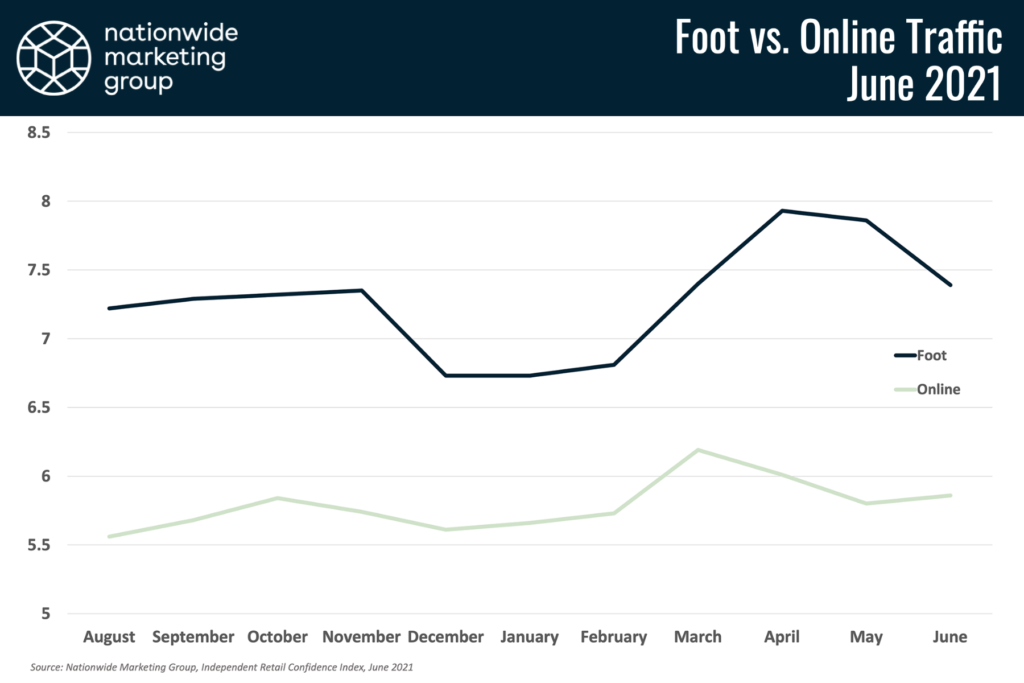

The increased uneasiness expressed by retailers in the latest NMG Index was also prevalent in their half-point dropoff in their confidence in their ability to drive foot traffic this month. The score there dropped to 7.39 (out of 10), down from 7.86 last month.

Retailers who were more confident in their ability to get consumers into their stores this month generally were the ones who cited increased marketing spend and awareness campaigns in their communities. In addition, those responses did tend to come from dealers who operate in locations where social distancing and other restrictions have been relaxed.

Another Strong Sales Month

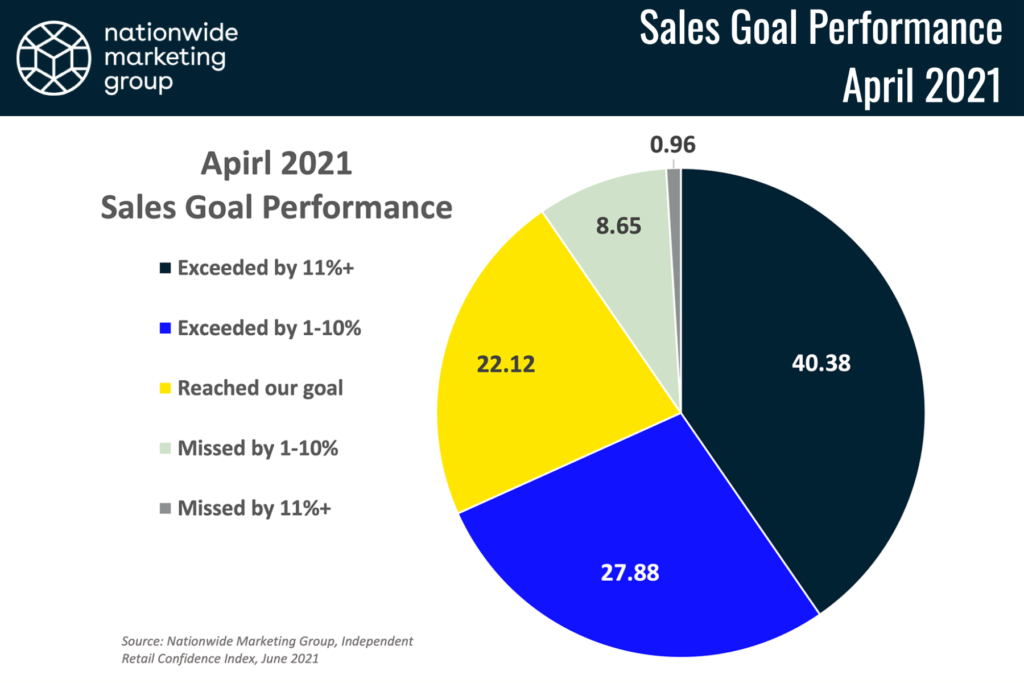

For the second month in a row, the percentage of retailers who met or exceeded their sales goal from the previous month exceeded 90%. Reporting for April, more than 40% of retailers said they exceeded their sales goal by 11% or more. Another 28% did so by between 1-10%, while an additional 22% reported meeting their goal. Just 8.6% of responding retailers missed their sales goals by between 1-10%, and less than 1% said they missed by more than 11%.

That data correlates nicely with the strong confidence that retailers reported in April, the month that the NMG Index set its all-time high. Turns out, the strong boost in confidence during that month translated into actual sales for the Independent retail channel.

Products Show Promise

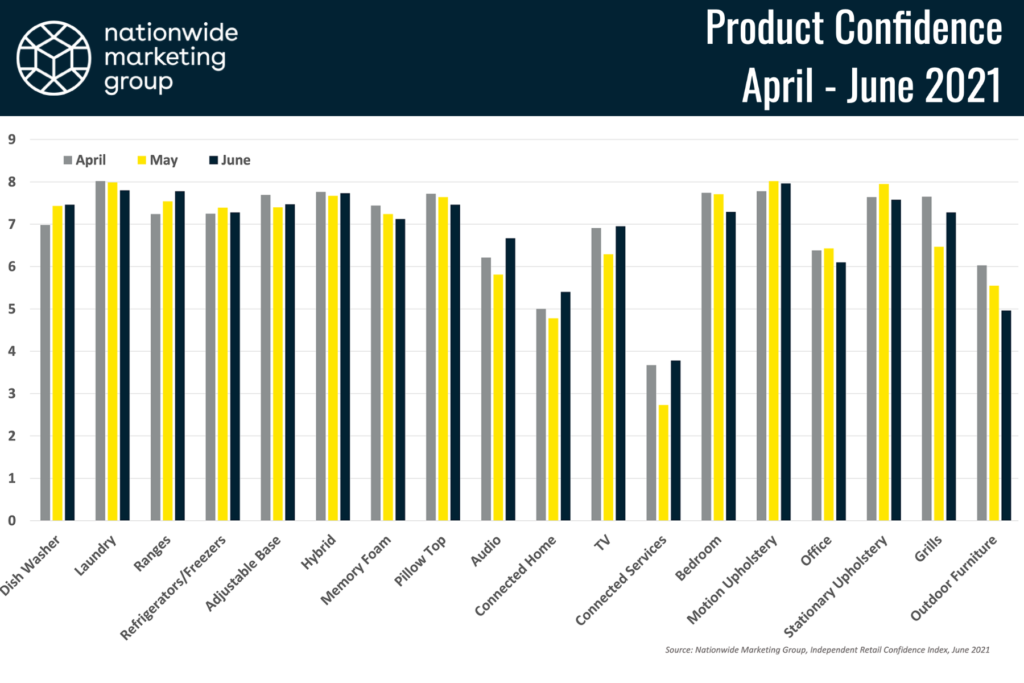

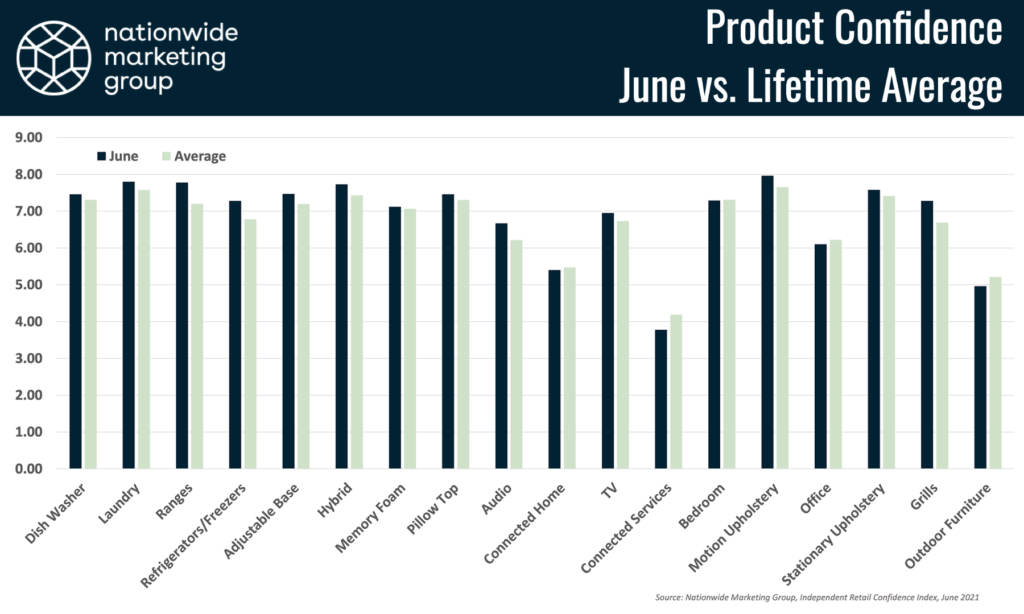

June was another great month for the individual product categories that the NMG Index surveys for. Accounted for collectively, the 18 product categories recorded an average confidence level of 6.89 (out of 10) — the second-best month to-date for products.

Interestingly, though, the jump in product confidence was driven by strong performance in the Consumer Electronics category. All four of the products surveyed four in CE (Audio, Connected Home, TV and Connected Services) saw their month-over-month scores jump at least 0.6 points. Grills also saw a significant boost over its May score. That roller-coaster-esque performance is actually somewhat predictable for these products, though.

Looking at all product categories over the past three months, they’ve been relatively flat across the board, with the only exceptions being the CE and Outdoor categories.

That said, 13 of the 18 product categories surveyed for were up over their lifetime averages in June.