Supply chains have been upended across every single category over the past year. The root cause is, of course, the global pandemic that (hopefully) is nearing an end. But each category has also faced its share of add-on obstacles. The furniture industry has been hampered by ongoing lumber shortages. Bedding is still fighting through foam shortages caused by a late-winter deep freeze. And appliance makers have been hurt by social distancing measures that reduced their capacity to produce product.

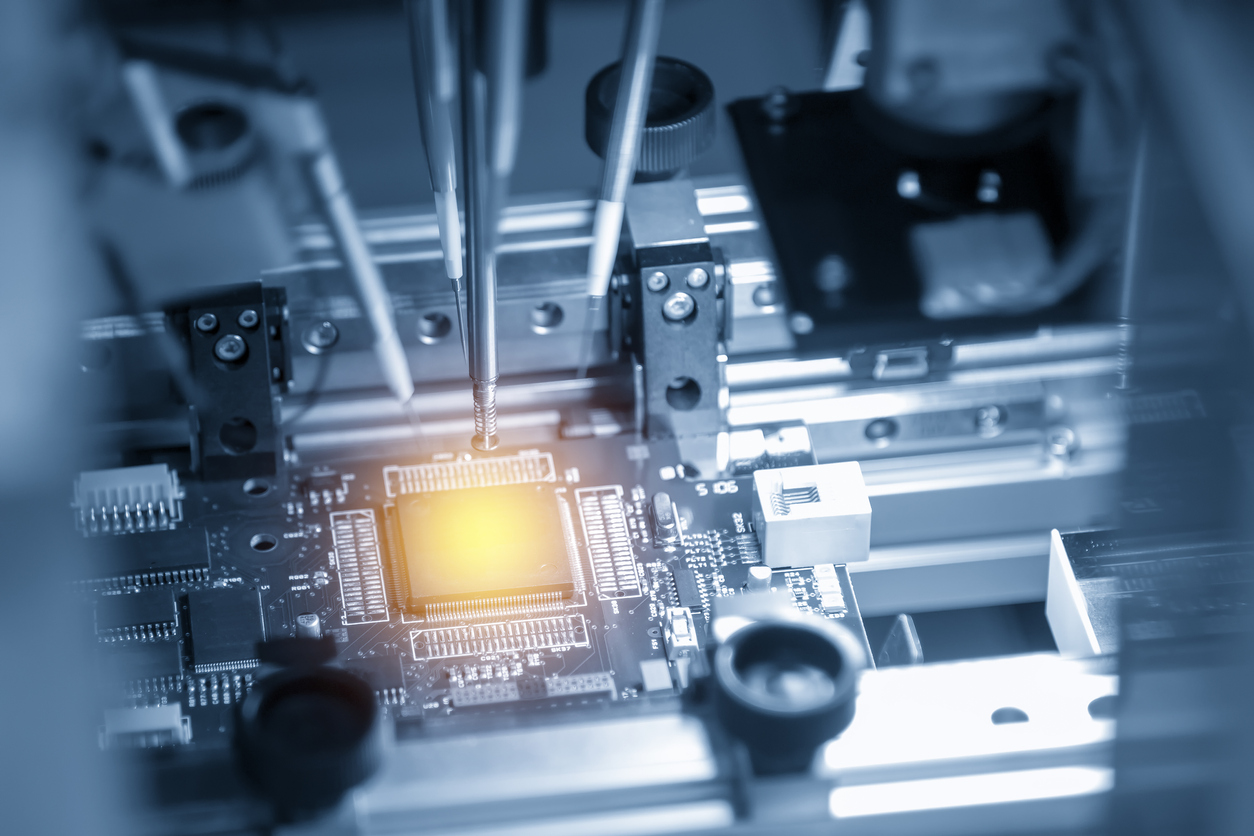

When it comes to consumer electronics, if you’ve been following the industry over the past year, you know that there’s been an ongoing component shortage that’s impacted nearly every piece of technology — as well as some of those smart appliances retailers have on their show floors. Everything from automobiles to TVs, computers, gaming consoles, smartphones, speakers, headphones, earbuds and so on have been impacted by the chipset shortage.

Nationwide Marketing Group Vice President of CE Lee McDonald shared his thoughts on the chip challenges and more during a recent interview for the Independent Thinking Podcast.

Independent Thinking: How are things in the CE category right now? What’s the outlook for this segment as we head into the back half of 2021?

McDONALD: It’s been a challenging time. And it seems like there’s just this compounding and escalating set of factors that continue to drive supply chain shortages. Last March, when the pandemic started, it truly was just a spike in demand and a shortage of containers to help retailers keep up with that demand. And then we had all of the unpredictable factors that happened with power outages at glass foundries in Japan, fires at other manufacturing facilities — all of these things that just compounded pressures on the supply chain over the past year.

The good news is the majority of the challenges that are addressable manufacturing shortages, those are coming to an end. By the time you’re reading this and we’re together for PrimeTime in August, we should see fill rates for Members around 70-90%. And, the great news, by the holidays we should be closer to 90-100% allocation availability. So it’s been difficult for the past few months, but it’s going to get better by the end of this year.

IT: You hit the nail on the head — so many compounding factors have hampered the supply chain. Most notably, there’s been this ongoing semiconductor shortage that’s impacted so many different product categories. What’s been going on there?

McDONALD: There was definitely a period where we didn’t understand the forecast and the chipset manufacturers didn’t understand the forecast. Part of the challenge is there’s not that many, really big chip set manufacturers, and they’re not very widely distributed, either based on core competencies or geography. TSMC, which is the largest chip set producer in the world — they fabricate about 80% of the entire world’s allocation — they use about 160,000 metric tons of water per day to make these chipsets. They use it to cool components, clean them out, and all sorts of stuff.

Well, they also have just come off of a year where first time in almost a decade, they haven’t had any typhoons. Add onto that the fact that they’re in the middle of a massive drought. Their local government is looking at it like, “Okay, we have to supply water to people before we can start making consumer durables.” So that’s complicating things as well.

IT: Despite all of these challenges, how has the CE business fared over the past year-plus?

McDONALD: It’s strong, despite all the challenges that we talked about. The business is up year over year. So depending on where you’re at in the country and what week it is, some retailers are up, some are down and it really just comes down to who can ship product. The industry as a whole is up around 7% right now, year to date.

But what’s really important to remember is that our manufacturing partners are ramping back up right now. Some are up 50% in units year-over-year. Some of our manufacturer partners have been producing goods 24 hours a day, seven days a week since essentially June of last year. So, even though it’s difficult to find product and we don’t have the inventory we want right now, that’s more of a function of demand and just some other supply chain and ecological challenges. Business is incredibly healthy and I would guess, and my forecast is that we will remain at that level of demand at least through the back half of this year.

IT: What is Nationwide doing to help Members get access to product?

McDONALD: I think back to Virtual PrimeTime in March. We saw the impending challenges through the middle of the year. We knew that there was going to be a little bit of a short-term inventory crunch, so we went into PrimeTime with over $30 million of TV inventory that was exclusively for our Members. And that’s one of the things that I’ve been talking to the Membership about a lot. Our Members really need to get hyper-focused on how they buy product this year. They can’t buy it just from one source. They have to have multiple sources. That’s one of the main value points of the group is we don’t force you to buy through one warehouse in order to get the show specials and shows program. We work with a network of seven incredible distribution partners who are willing to hold inventory aside for us, who are willing to give 120 days credit terms.

Kudos to our distribution partners, they are protecting and continue to hedge inventory for the independent channel. And again, that’s one of our core competencies and our strengths. So, securing inventory, but also following up with deeper promotions than we’ve ever had before.

IT: What opportunities exist for CE dealers over the final months of 2021?

McDONALD: Consumers are more willing to have a conversation and be open to discussing things than they may have been in the past. They’re just thinking differently about their purchases, thinking about how they’re going to interact with the product. And so, they’re more open-minded than they have been in the past. For Members, it’s just thinking about their business a little bit differently, maybe bringing in some categories that they’ve gotten away from, going a little bit deeper into other categories that they have in the past. But then also just making sure that the staples of warranty and service are forefront in the minds of their salespeople.