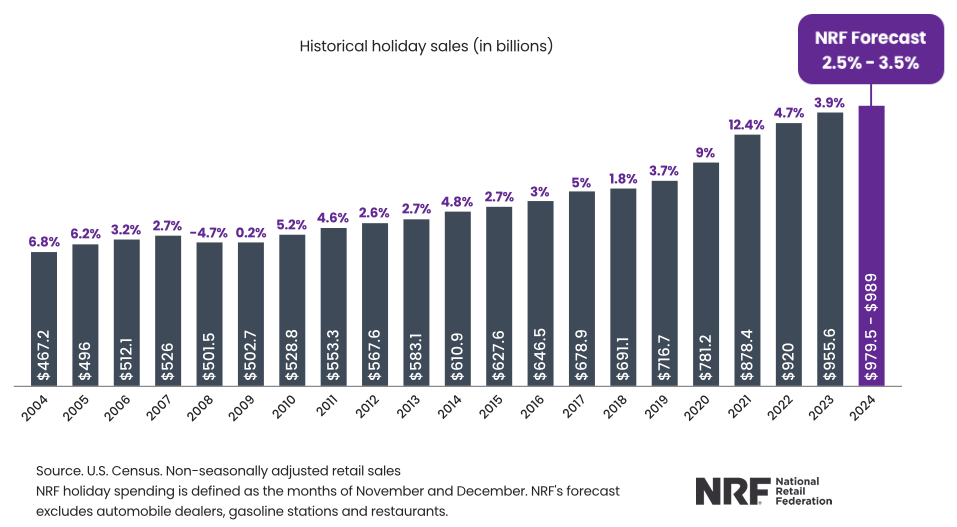

As the election comes to pass and consumers get back to their regularly scheduled shopping habits, attention will shift towards the final few weeks of the year and the all-important holiday shopping season. Despite the obvious headwinds consumers and retailers have faced this year, the National Retail Federation (NRF) expects steady growth in overall spending during the November and December timeframe. The trade association’s holiday spending forecast sets growth for the retail industry between 2.5 percent and 3.5 percent from 2023, or between $979.5 billion and $989 billion.

“The economy remains fundamentally healthy and continues to maintain its momentum heading into the final months of the year,” NRF President and CEO Matthew Shay said in a statement accounting the association’s forecast. “The winter holidays are an important tradition to American families, and their capacity to spend will continue to be supported by a strong job market and wage growth.”

According to NRF, the primary driver of growth will be online shopping and other non-store sales. Those areas are expected to see an increase between 8 percent and 9 percent compared to last year, representing a total of between $295.1 billion and $297.9 billion. That would represent another year of significant growth in the online and non-store sales segment – last year, the figure rose 10.7 percent over 2022 totals to around $273.3 billion.

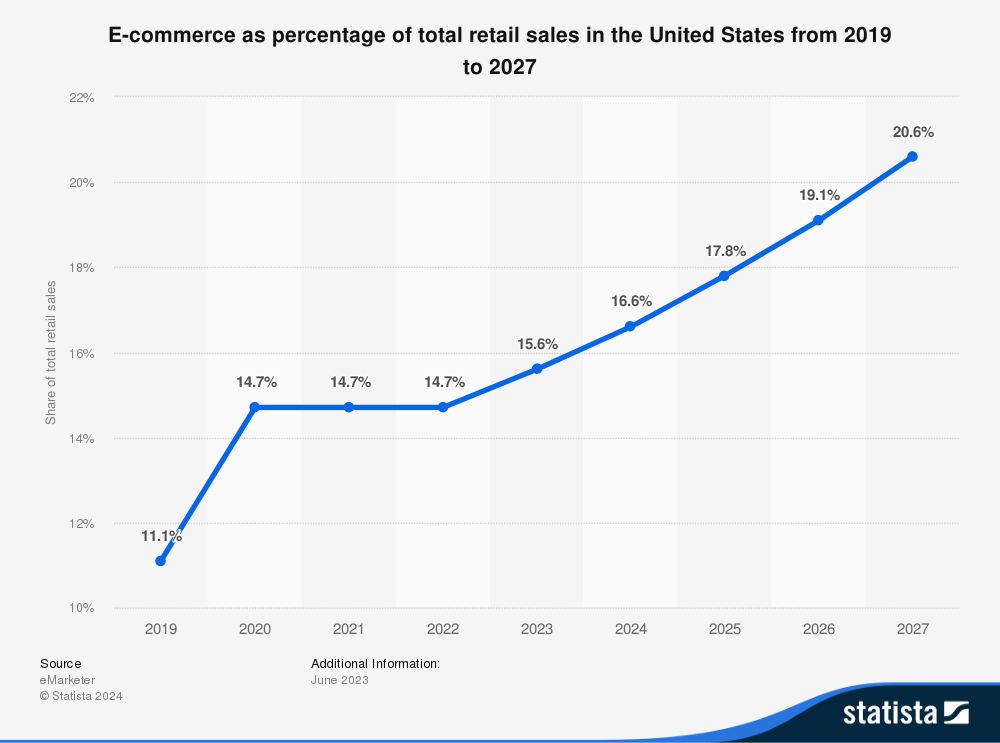

If the totals hold true to NRF’s forecast, online and non-store sales would represent around 30.1 percent of all holiday sales. That’s significantly higher than the 16.6 percent of all retail sales that e-commerce will represent for 2024 – a sign that consumers a particularly interested and intend to avoid crowds and potential inventory challenges in-store by shopping from home during the holiday period.

“We remain optimistic about the pace of economic activity and growth projected in the second half of the year,” NRF Chief Economist Jack Kleinhenz said in the release. “Household finances are in good shape and an impetus for strong spending heading into the holiday season, though households will spend more cautiously.”

While the NRF forecast is inclusive of the entire months of November and December, the association notes that retailers will be under a tighter time constraint this year with the holidays. With Thanksgiving occurring just about as late as possible this year, retailers will have five fewer days between the Black Friday weekend and Christmas – 26 days total.

Other contributing factors this year, NRF highlights, include the economic impact of Hurricanes Helene and Milton and, of course, the U.S. presidential election.