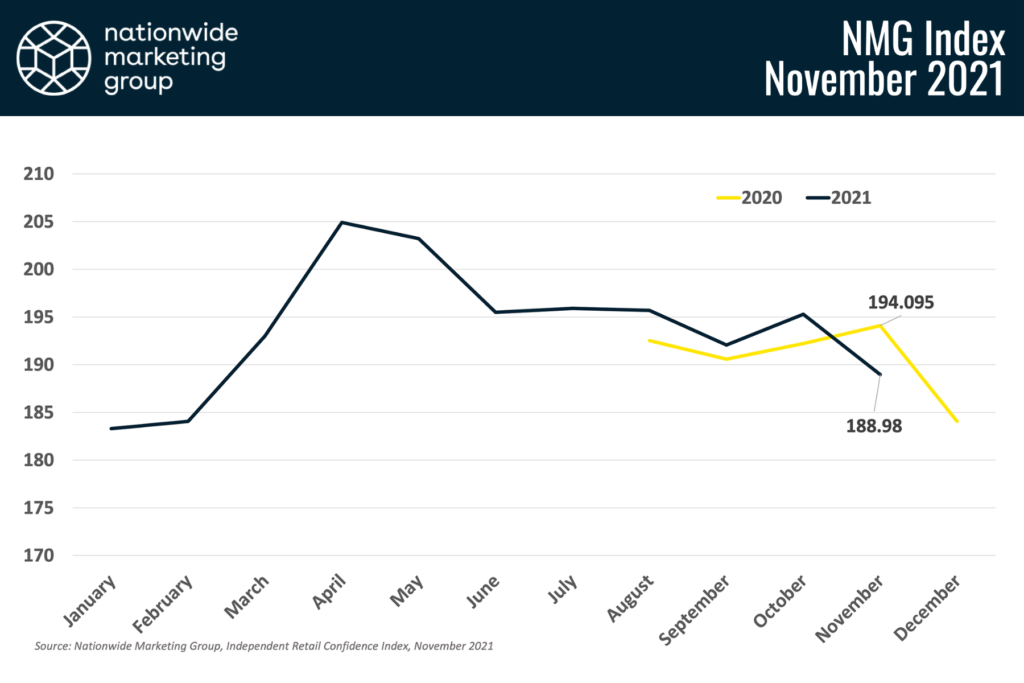

In the face of continued supply chain challenges, independent retailers took just their second big confidence hit of the year, heading into November. With Black Friday staring them in the face, retailers this month checked in with an overall confidence score of 188.98, down a little less than 6.5 points, according to the latest Nationwide Marketing Group Independent Retail Confidence Index survey. On the percentage scale, the November confidence score registered at 67.25%, down 2.25% from October.

November represented the first month that the year-over-year score was lower in 2021 than it was last year during the same month.

The dropoff in confidence comes as retailers are gearing up for the all-important holiday shopping season. It also follows a five month stretch during which the NMG Index appeared to be teetering on the ledge. Retailers have continued to report relatively steady confidence levels over the past few months despite their incessant concerns around either a lack of supply or slowing demand in their area.

“We’ve got pretty good inventory on most categories, but we are really short in some which could throw a big wrench in things,” said one retailer. “Also, we’re not sure how customers will approach this season: will they be conservative or spend?”

Another retailer noted that, at a time when product availability is top-of-mind for most consumers — can I get it right now? — they believe that fact may be working against independents. “I believe customers are of the mindset that availability is the most important aspect to the purchase. They do not trust independents to be able to meet demands,” they said.

Is Black Friday Losing its Luster?

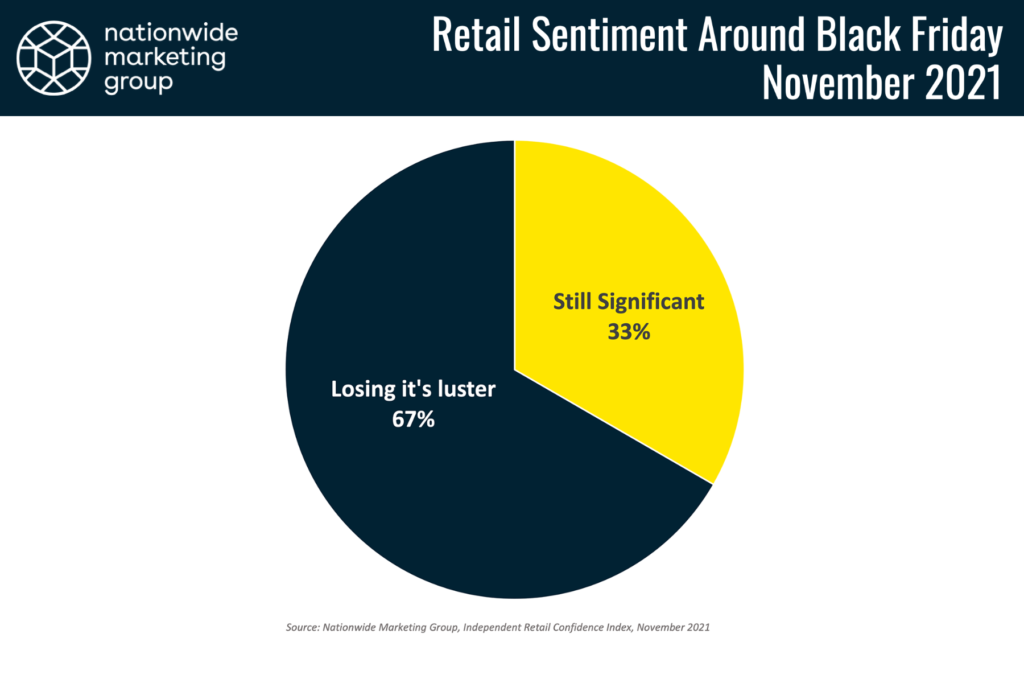

A really interesting note that came out of the November survey, retailers appear to be cooling off on the idea that the Black Friday holiday shopping weekend (from Thanksgiving Thursday through Cyber Monday) is still a major event.

When asked if that five-day stretch was still considered a significant shopping event for their store, just 33% said yes. The remaining 67% said the weekend, which has traditionally been the unofficial start of the holiday shopping season, is losing its luster.

This year, that certainly has felt true. According to the National Retail Federation, 49% of consumers began their holiday shopping before the calendar even turned to November — a solid three weeks before the Black Friday weekend. In fact, many retailers have been promoting “early Black Friday” deals since late September.

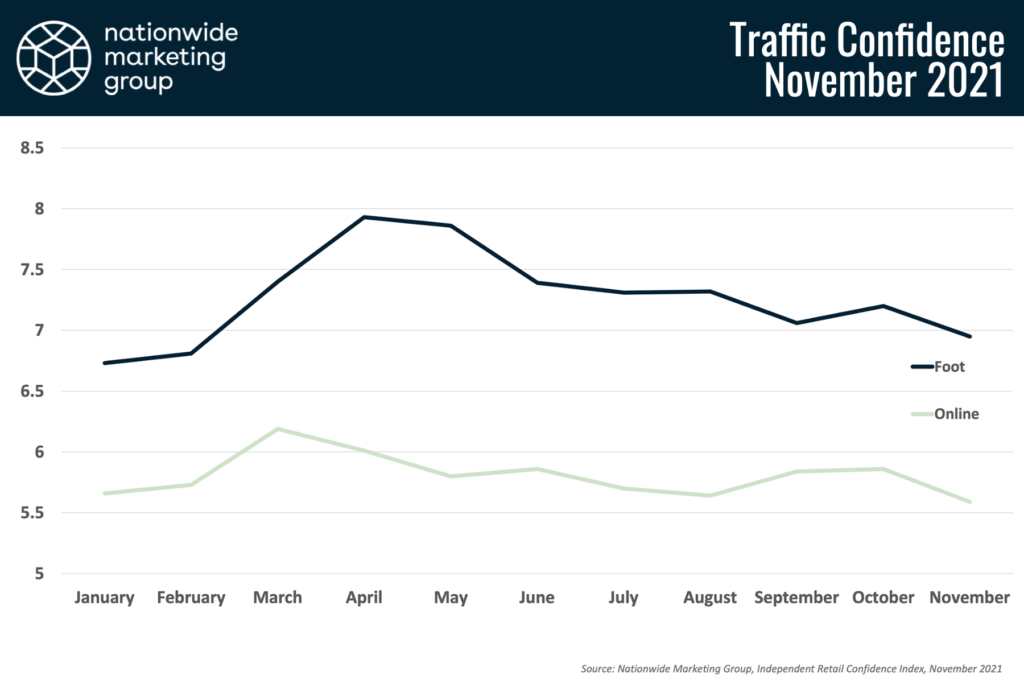

Retailers’ waning belief that the Black Friday weekend is a major deal is also evident in their declining traffic confidence heading into November. Though it has zigzagged over the past few months, retailers reported a lower confidence level in their ability to drive in-store and online traffic in November. This, despite this looming presence of the Black Friday holiday shopping weekend, which has set single-day online shopping records over the past few years and still been a major driver of in-store traffic

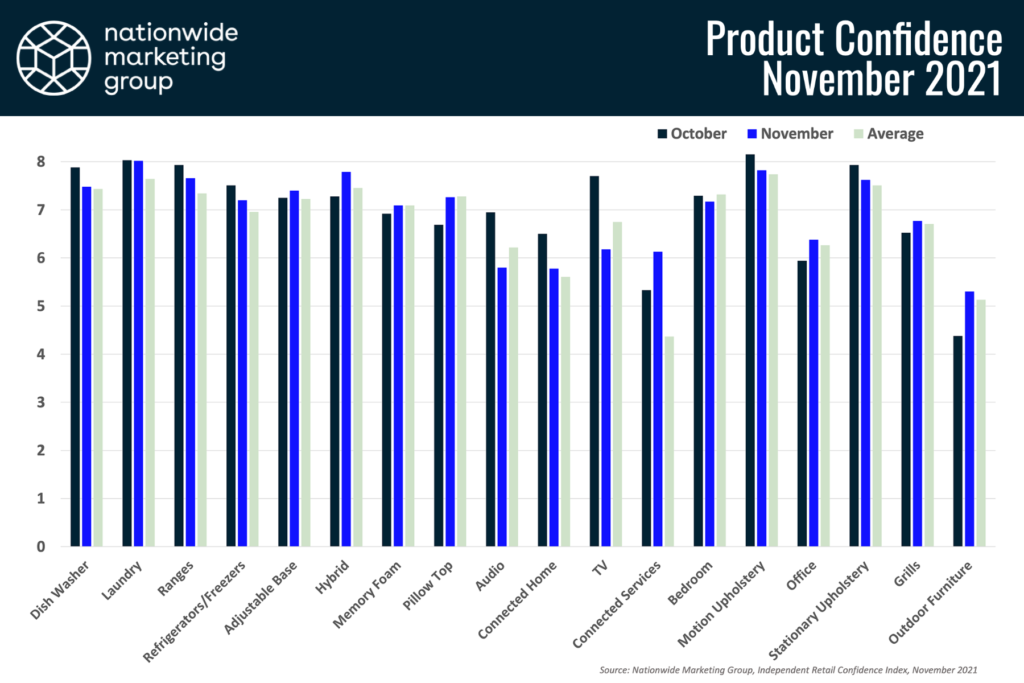

Confidence Still Strong on Products

Despite the lackluster performance of the NMG Index as a whole, November was still a relatively strong month from a product category perspective. This month, 13 of the 18 product categories surveyed for outperformed their lifetime average monthly score. November actually proved to be the fourth-highest performing month for products (a combined average score of 6.94) since the NMG Index launched in August 2020.

The strong monthly performance for products was helped by the fact that Connected Services had their best month to-date, scoring above 6.1, or more than 1.6 points above its lifetime average. In addition, all Appliance and Outdoor categories performed above their lifetime averages, along with three out of four Furniture segments.

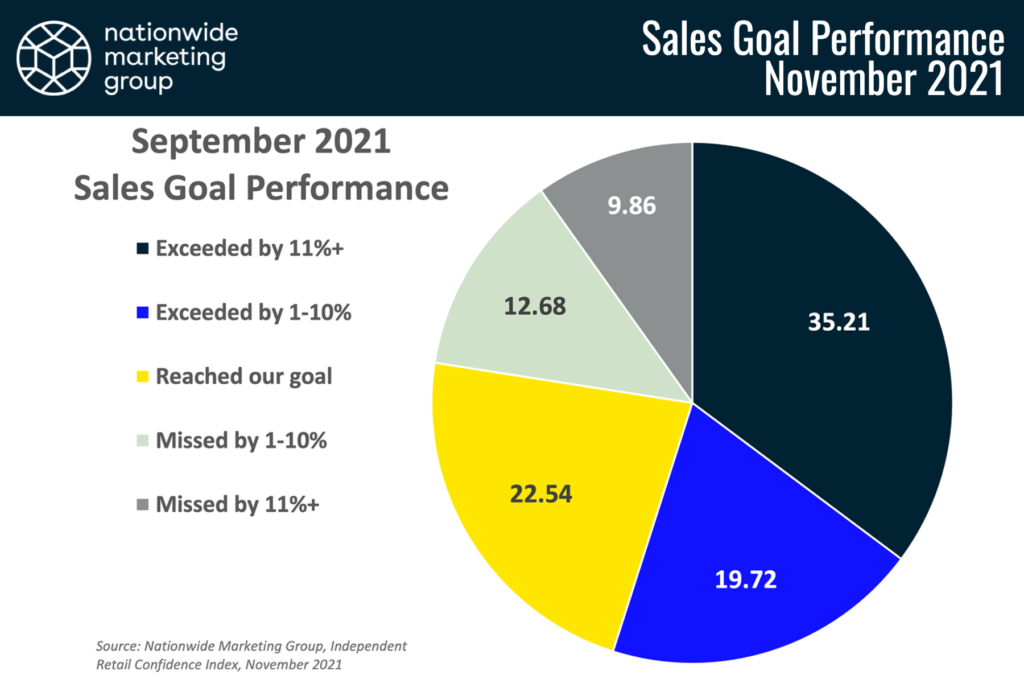

Sales Goal Performance

The lagging confidence level may also have been impacted this month by sales goal performance that hit a bit of a speedbump in September. While more retailers reported exceeding their sales goals by more than 11% (35% in Sept vs. 29% in Aug), nearly 10% of dealers missed their sales goals in the month by just as wide a margin (up from 2.3% in Aug).

Interested in signing up to be a part of our monthly NMG Index surveys? Fill out the form at the link right here.