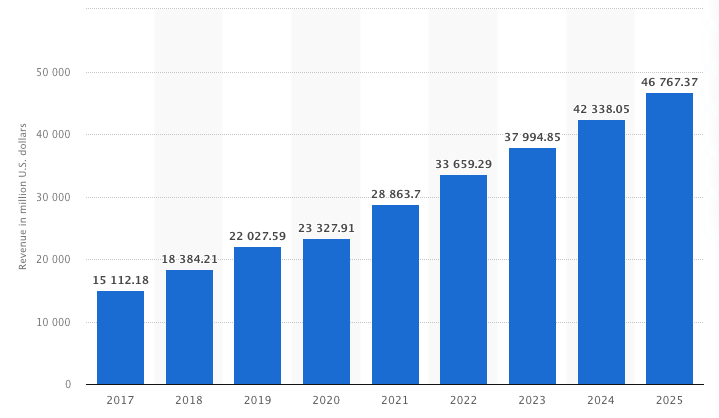

Let’s be clear, the Smart Home never really went away here in the U.S. Industry data from Statista shows that smart home revenue locally was up in 2020, reaching more than $23.3 billion in sales. That figure represented a slowdown in the annual growth rate, sure. But we know the reasons for the “slowdown,” from the pandemic to the ongoing chip shortage and supply chain challenges.

Source: Statista

However, on a global scale the smart home market did actually contract in 2020. According to market research firm Strategy Analytics, 2020 smart home sales dipped below the $100 billion mark after hitting $103 billion in 2019.

Hence, we’re here talking about a roaring comeback.

Statista’s numbers alone show a jump in smart home revenue in the U.S. of nearly 24% in 2021, falling just shy of $29 billion. Globally, Strategy Analytics’ data has the smart home market growing 44% year-over-year to $123 billion.

According to the latter, pent up demand in some 30 million households will be the main driver of growth in the sector. The firm’s data suggests that North American smart home sales will account for 40% of the global spend, or around $49.2 billion.

As for the types of smart home products consumers are showing most interest in, Strategy Analytics highlighted the home security category. Security systems are the dominant product category in the U.S. and Western Europe, the firm says. Specifically, consumers show high interest in surveillance cameras, smart bulbs and electrical devices.

Interestingly, Strategy Analytics’ data shows that the Asia-Pacific region has more homes with connected devices installed in them. However, spending per household was half that of smart homes in the U.S.

Research from the Consumer Technology Association found that nearly 70% of homes in the U.S. have at least one smart home product. The smart home is a market that continues to have untapped and seemingly unlimited potential — especially here in the U.S.