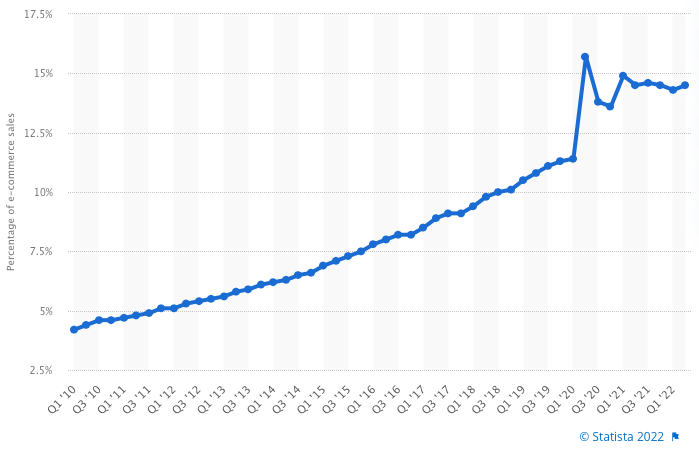

It’s true that online shopping exploded during the early months of the pandemic. It had to almost out of necessity as stores were closed and lockdown orders were put in place. E-commerce as a total share of retail revenue during Q2 2020 skyrocketed to nearly 16 percent, according to the U.S. Census Bureau’s data — a 4 percent leap from the previous quarter.

But here’s the thing: Much like the broader retail industry, e-commerce experienced some extreme fluctuations over the ensuing months. As quickly as it shot up during that first quarter of the pandemic, e-commerce’s share of total retail sales dropped down 2 percent during the very next quarter — it’s most significant decline since that data has been tracked. Further, while the share of e-commerce sales had been steadily increasing over the previous decade, the figure has actually declined in five of the past eight quarters.

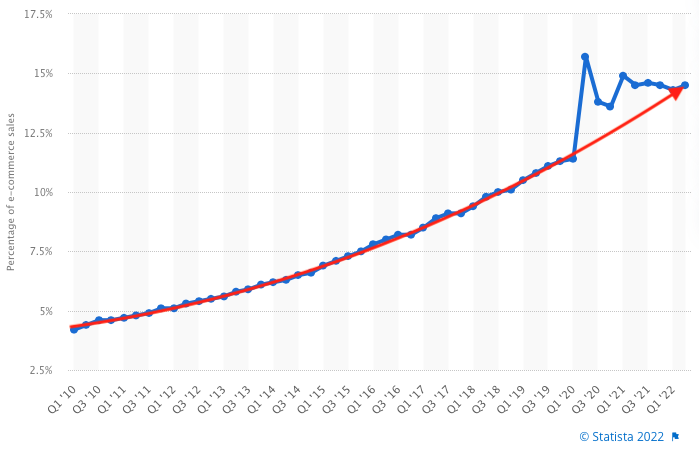

Something we’ve been hearing a lot about in regard to the economy of late is the idea that things are “normalizing” or returning to the way they were pre-pandemic. The same might be said about the excessive growth that e-commerce saw during the height of the pandemic. If you were to ignore the spikes and drop-offs in the most recent quarters in the chart above and you simply tracked the overall trend line, we’re probably right back in line with how e-commerce has been expanding over the past decade-plus.

That growth isn’t going to slow down either. Estimates from the Statista Digital Market Outlook show e-commerce revenue reaching $1 trillion for the first time as soon as next year, and $1.3 trillion by 2025.

Where Are the Dollars Going Online?

So, consumers are spending more online. Captain Obvious tips his cap in agreement.

But not all product segments are created equal in the e-commerce world. As a retailer, it behooves you to understand where those dollars are going and how consumers prefer to shop online.

For starters, the American consumer is perhaps the most willing consumer in the world to open their digital wallet. While the global average per online order is roughly $93, Americans top that with an average order of more than $109. We lead the world in that category, according to a recent ecommerceDB report.

That report dives even deeper into the different product categories and how they perform online. Not surprisingly, online shopping is dominated, revenue-wise, by the categories that are well-rooted in this space — things like books, music, media, consumer electronics, computer equipment, toys and hobby accessories, office supplies and apparel. Consumer electronics, as an example, saw 53 percent of total retail sales done online last year.

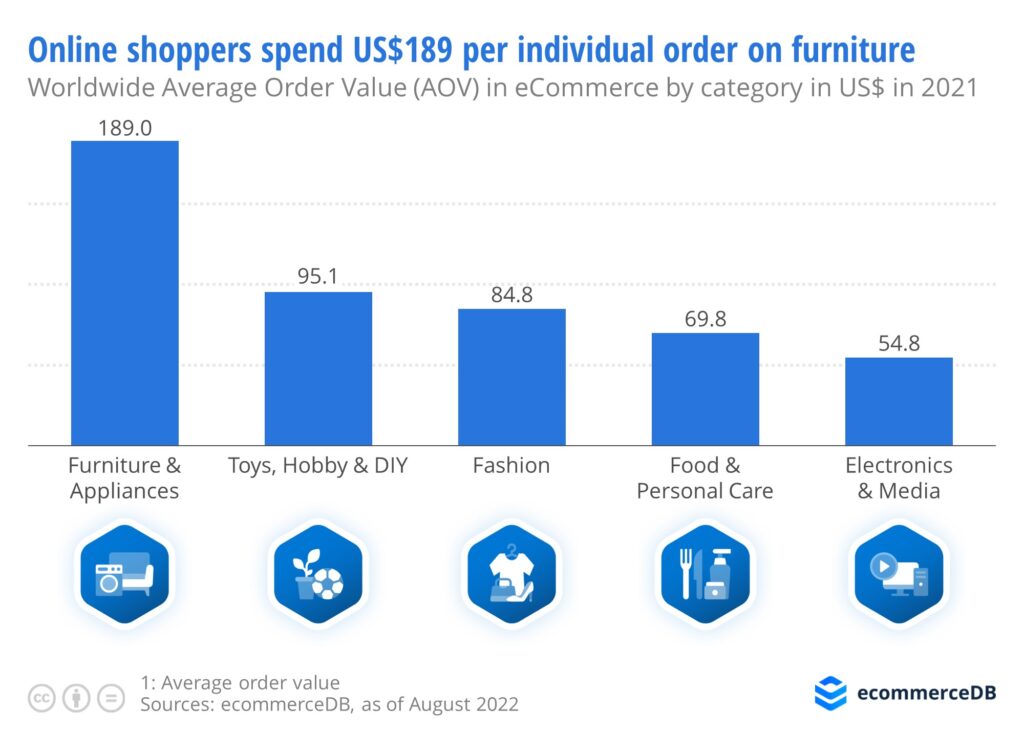

When it comes to appliances, furniture and bedding, though, roughly 30 percent of retail sales in those categories came online. That said, the average online order for those categories was more than triple that of the electronics and media segment. According to ecommerceDB, the average furniture and appliance online order was $189 last year.

Of course, appliances and furniture are inherently more expensive than most consumer electronics items — or any other consumer good for that matter. But the fact remains, consumers are showing a willingness to purchase those products online.

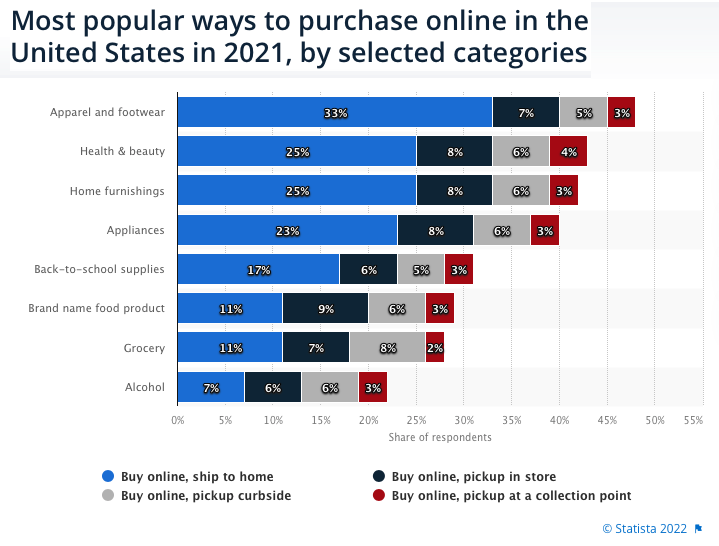

That said, the pandemic did prove to us that just because a product is purchased online doesn’t mean a retailer has lost the ability to bring that consumer in-store. Buy-online-pickup-in-store (BOPIS) orders were quick to gain momentum during the pandemic, and they’ve continued to remain popular as we come out of it — especially in the home furnishing and appliance markets.

According to a recent Salesforce survey, while 23 percent and 25 percent of appliance and home furnishing shoppers, respectively, prefer to have their purchases shipped to their homes, 14 percent (in both categories) prefer to buy online and either get the product curbside or pickup in the store.

The fact remains, in the markets that matter most to the independent appliance, furniture, bedding and high-end consumer electronics retailers out there, the in-store experience still drives the majority of business. You serve a high-touch segment that relies on consumers seeing and experiencing the product. It’s hard to get a sense of just how comfortable a couch or mattress is by reading about it online.

At the same time, understand that you need to provide an equally well-executed experience online. Is your online shopping cart turned on? Do you give customers the option to buy online and come into your store to get the product? Are they able to make a purchase with their preferred payment method? Can they easily get in touch with you or a sales associate either through a web chat function or another method?

E-commerce isn’t going to stop growing any time soon. Make sure your business is positioned to grow right along with it.