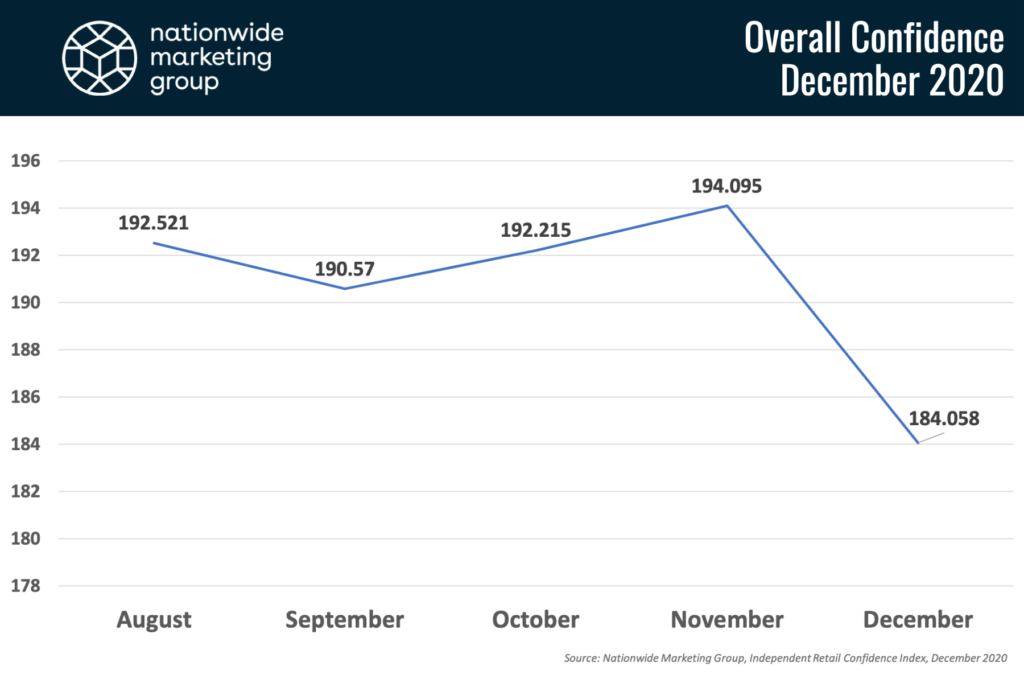

Demand for product remains strong during the final month of a mostly forgettable 2020, according to Independent retailers who responded to the latest Nationwide Marketing Group Independent Retail Confidence Index survey. However, a number of outside factors pushed retailers’ confidence down a little more than 10 points in December.

The NMG Index checked in at 184.058 this month, down from a survey high of 194.095 in November. On the percentage scale, Independent retailers still rest firmly on the confident side of things at 65.5% (down from 69.1% last month).

So why the drop-off in confidence?

According to many retailers who responded to this month’s survey, their reduced confidence heading into December had to do with a resurgence of the coronavirus pandemic in their communities and the continued struggles around inventory availability and other supply chain issues.

“We’re worried about product and stock levels, if that is met then we should definably hit a revenue,” said one retailer. “But as a small business we’re seeing very low inventory levels, and very minimal trucks with new merchandise arriving to our doors.”

Another said, “With the COVID numbers rising and the fact that so many of our furniture orders are delayed I am concerned that people will be staying at home and our orders may be pushed out more.”

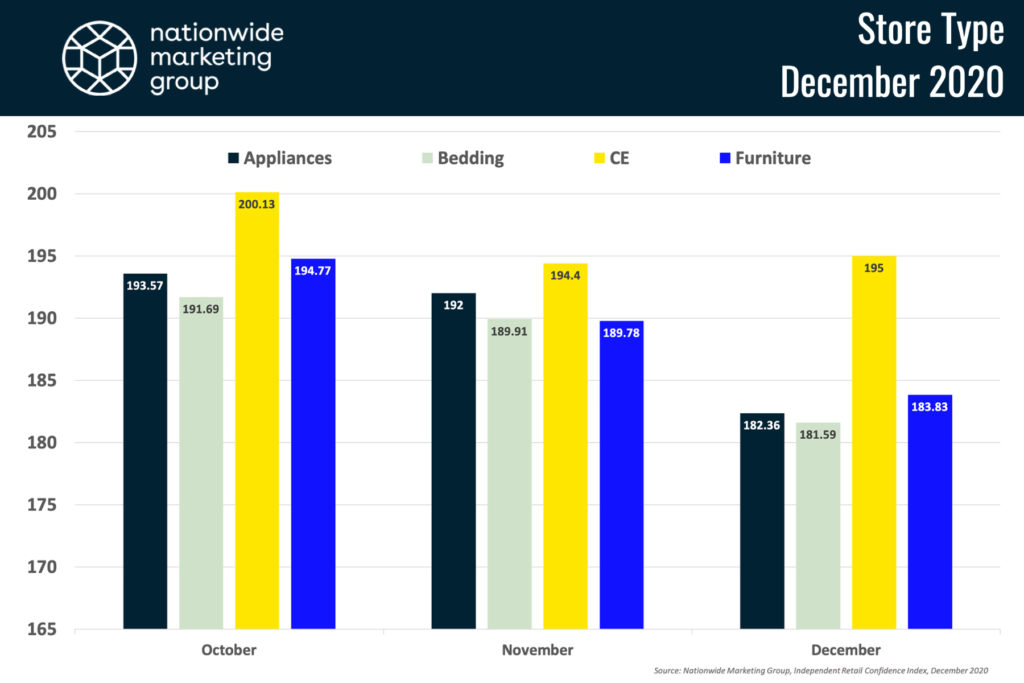

Despite the poor timing of the drop-off in confidence during the holiday shopping season, a deeper dive into the December NMG Index shows that at least one corner of the Independent retail channel is still riding high this month. Consumer Electronics dealers were an outlier in this survey, checking in with a confidence score of 195. The holidays have historically been a strong time of year for the consumer electronics category, and the confidence level of the retailers in this segment certainly reinforces that fact.

COVID’s Impact on Traffic

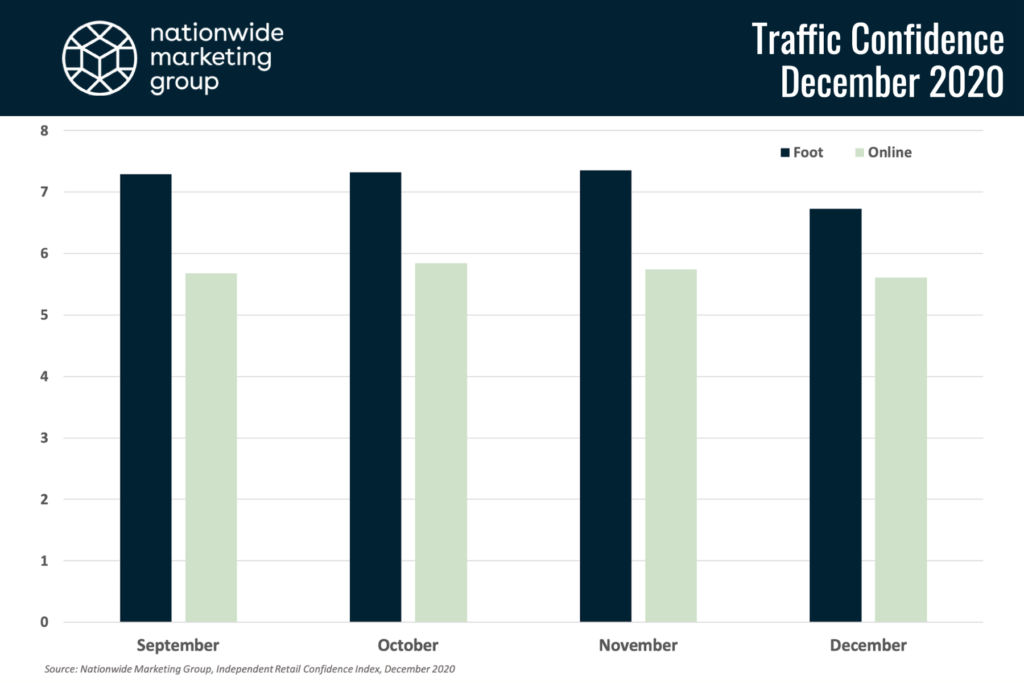

As with the overall NMG Index score in December, COVID played a hand in impacting retailers’ confidence in their ability to drive foot traffic this month. Independent retailers’ confidence in their ability to drive foot traffic in December dipped below 7.0 (on a scale of 1-10, with 10 being the most confident) for the first time in this survey’s five-month history.

“I would have been more confident a month ago, but business has seemed to soften a little in the last few weeks, and the virus is surging now, with our state initiating more lockdowns,” reported one retailer.

The dip in foot traffic, while a difficult pill to swallow this time of year, comes almost as no surprise and perhaps as expected with the surge of the coronavirus across the country. According to Adobe Analytics, Black Friday foot traffic at retail fell off a cliff in 2020, dropping more than 50% compared to last year. While not entirely absolving retail of potential revenue shortcomings, Adobe did report that online spending on Black Friday surged more than 21% compared to last year, reaching a record-setting $9 billion. That was quickly followed up with another record-setting day on Cyber Monday when, according to Adobe, U.S. consumers set a single-day record for online spending, handing more than $10.8 billion to retailers virtually.

Interestingly though, and perhaps a little troubling, is the fact that retailers’ confidence in their ability to convert online traffic remained nearly unchanged, according to the latest NMG Index. The December report found online conversion confidence at 5.61 (on a scale of 1 to 10, with 10 being most confident), which was down slightly from 5.74 in November. Most responding retailers cited a lack of e-commerce capabilities or yet-to-be executed plans to upgrade their web presences as the main reasons for the lower online confidence level. Those figures represent a major opportunity for the Independent retail channel to capitalize on consumers’ growing reliance on e-commerce in the face of the coronavirus pandemic.

Sales Goal Performance Hangs Tough

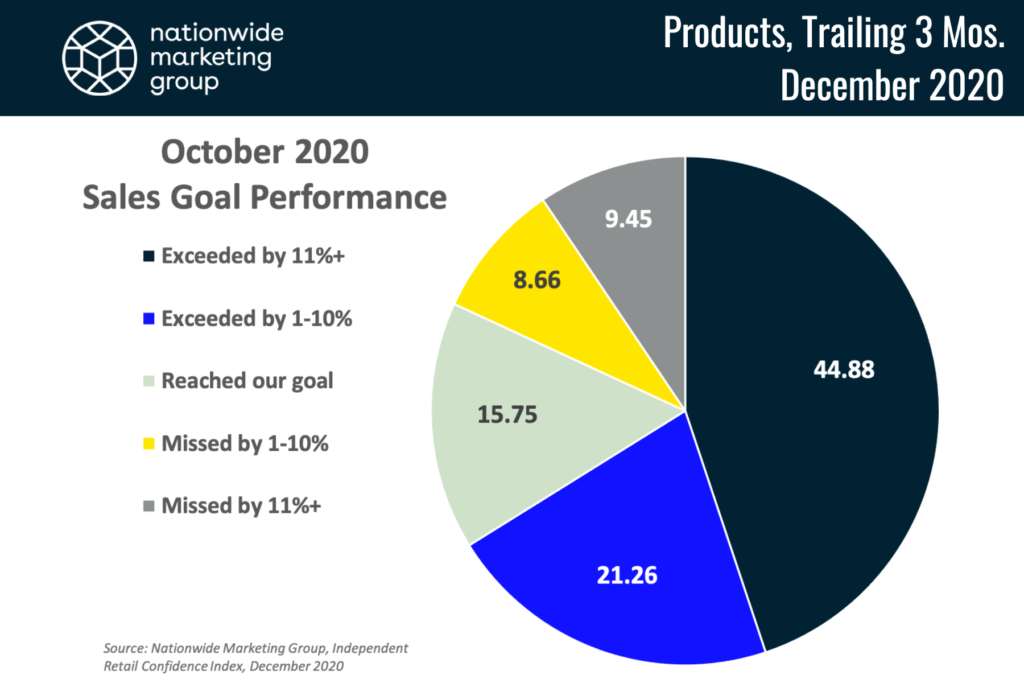

Despite the setback in confidence, retailers reported sales goal performance that showed just how resilient the industry has been during these challenging times. More than 80% of retailers reported exceeding or meeting their sales goals from October.

The sales goal performance, while down slightly from previous months, shows that demand from consumers is still strong, and that Independent retailers have been able to properly forecast during otherwise unsettled times.

Year in Review for Products

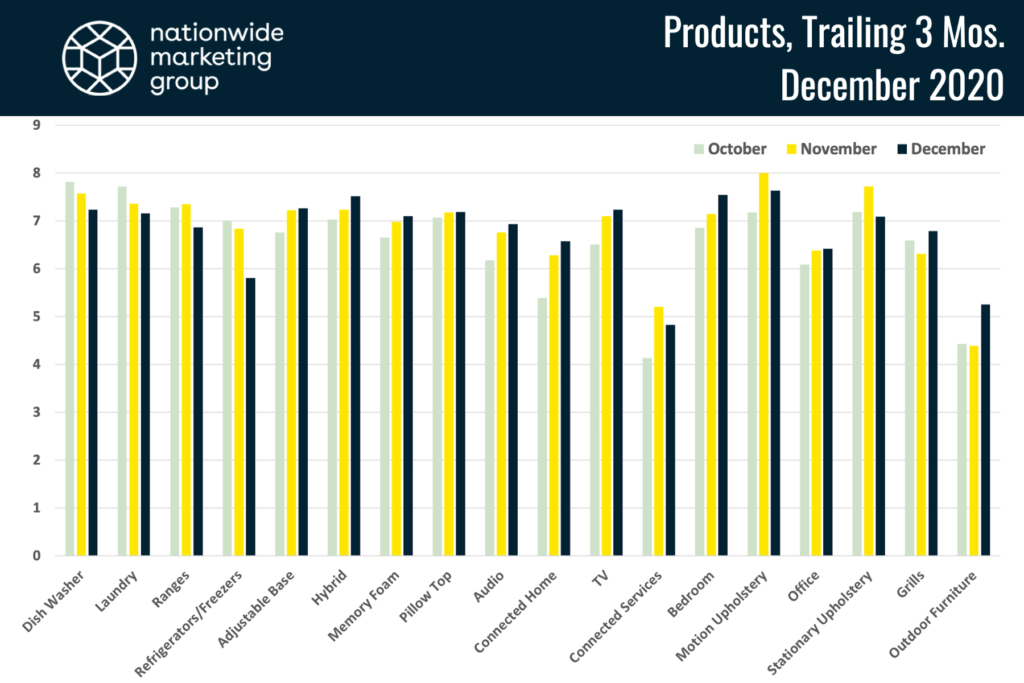

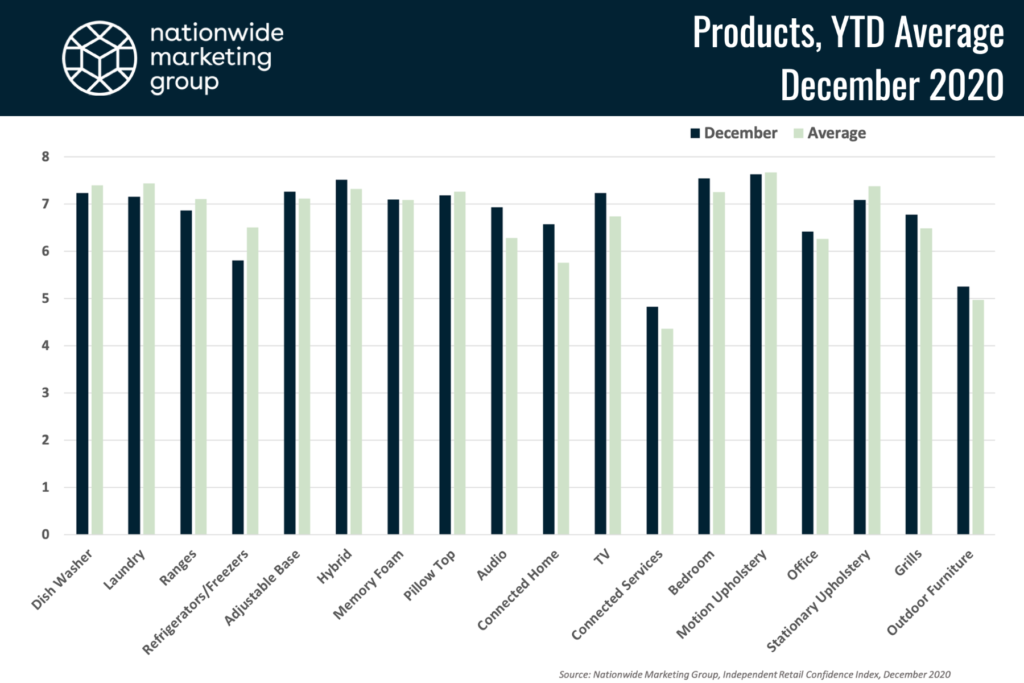

Products were another segment of the NMG Index report that still had a relatively positive month despite the slight downturn in overall confidence. All told in December, 10 of the 18 product categories outperformed their average confidence score to date. Looked at collectively, all products together averaged a score of 6.8 (out of 10) in December, which represents their second-best month on record behind November (6.83).

Again, not surprisingly, the strongest performance among products was seen in the consumer electronics category. All CE subcategories that the NMG Index surveys for — Audio, Connected Home, TV and Connected Services — outperformed their overall average, and, with the exception of Connected Services, were up month over month.

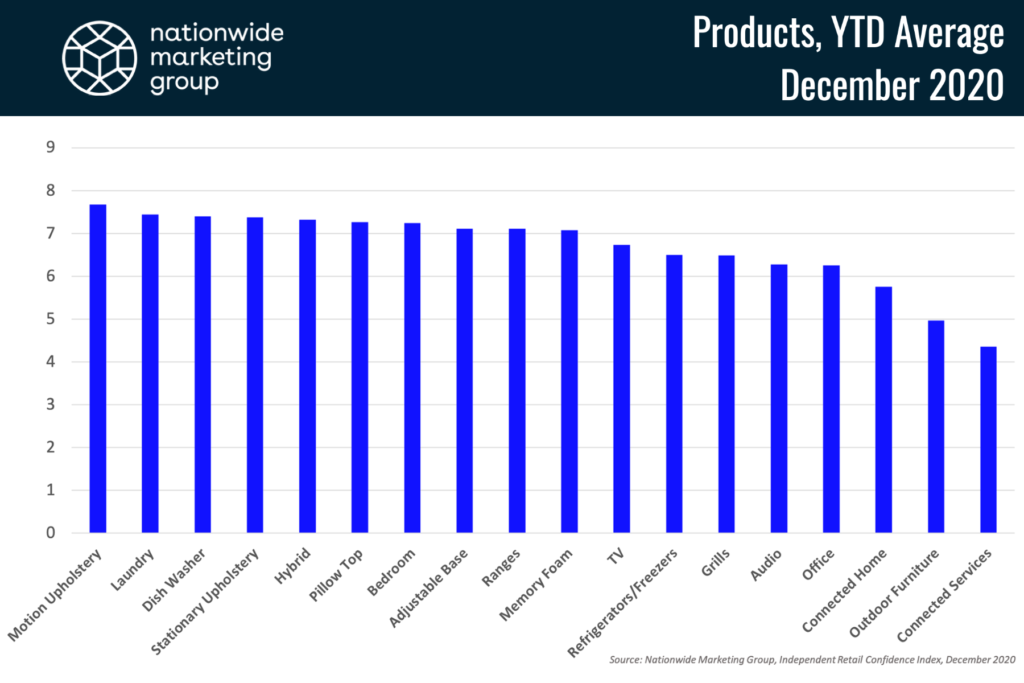

This end-of-year timing also presents an opportunity to look at how the individual product categories performed among retailers throughout the course of the year. Though this is just the fifth month of the NMG Index, the sample size still allows us to get a clear picture of how highly-rated each category is.

What we find, in this first “annual review,” is that Furniture and Bedding and Appliances really dominate the top of the scale and represent the products Independent retailers are most confident in their ability to sell. That said, 16 of the 18 product categories that the NMG Index surveys for all check in within roughly a point of each other. In fact, half of the products sit within a range of less than half a point of each other.

The other layer to this story and to the NMG Index that needs to be taken into serious consideration is that the strong confidence levels that the Independent retail channel has reported during the early months of this survey are set against the backdrop of a global pandemic, an unsettled supply chain and serious strains on inventory availability. Despite all of that, NMG dealers who’ve shared their insights with us remain steadfast in their commitment to serving their communities, and they remain confident in their ability to perform in the face of any and all challenges.